It’s been a bit tough for the equity markets, to say the least, recently. But the secret to success in stocks is not to get scared out of them as every downturn has been followed by an upswing of far greater magnitude, notes John Buckingham, editor of The Prudent Speculator.

It is a market of stocks and returns over the last couple of years show wide dispersion, similar in magnitude to what was seen after the bursting of the Tech Bubble in the year 2000. But not surprisingly, the recent market downturn has soured the mood of folks on Main Street.

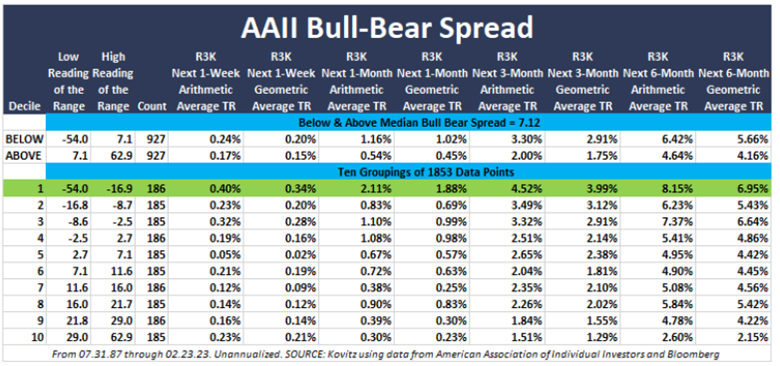

The latest read on Sentiment from the American Association of Individual Investors (AAII) saw the number of Bulls plunge by 12.5 percentage points and the count of Bears jump by 9.8 percentage points. Of course, the AAII gauge historically has been a very good contra-indicator for returns going forward and the current Bull-Bear reading of negative 17.0 is in first decile (most pessimistic) of the readings since the inception of the data in 1987.

As the chart above illustrates, returns over the ensuing week, month, three months, and six months for that first decile have been the best of the lot, illustrating why it can pay to be greedy when others are fearful.

No doubt, that is easier said than done, as the financial press usually does its part to instill fear. For example, the front page of Saturday’s Wall Street Journal trumpeted “Stocks Post Worst Week of 2023”, warning “Hot economic data rekindled worries that a more restrictive Federal Reserve policy will persist.”

We respect that many are worried about Jerome H. Powell & Co., especially as the Fed’s preferred measure of inflation, the core personal consumption expenditure (PCE) index rose 4.7% in January, above the consensus forecast for a 4.4% advance, and higher than the revised year-over-year advance of 4.6% in December.

But the labor market remains robust with jobless claims still near five-decade-plus lows. What’s more, the odds of recession over the next 12 months, as tabulated by Bloomberg, retreated to 60% last week, down from the 65% level that had been in place for the past few months.

There is much hand-wringing over a “hard” or “soft” landing, but the historical evidence shows that even if the U.S. economy officially enters a recession, long-term-oriented investors should stick with stocks…while history shows that stocks have been a very good hedge, on average, against high inflation.

To be sure, past performance is no guarantee of future returns and anything can happen as we move forward, but we present tons of data to try to keep our readers on the path to achieving their long-term investment objectives. After all, as Lao Tzu stated, “If you do not change direction, you may end up where you are heading.”

We sleep very well at night, given the inexpensive valuation multiples and generous dividend yields associated with our managed account portfolios.

Recommended Action: Stay the course.