Our Total Return Model Portfolio focuses on maximizing long-term total return. One stock that has been in the portfolio since July 2016 – and that we STILL like despite macroeconomic concerns – is Apple Inc. (AAPL), notes analyst Angelo Zino in CFRA Research’s flagship newsletter, The Outlook.

To enter the model portfolio, a stock must have a current yield equal to or greater than that of the S&P 500. The company must not have cut its regular dividend in the last five years and that dividend must be secure in the opinion of the CFRA equity analyst who follows the stock.

Apple is a name that makes the cut. The ubiquitous technology company makes smartphones, tablet devices, and computers. The company also sells a variety of related software, services, and accessories. AAPL primarily competes in the handset, tablet, computer, and media player markets.

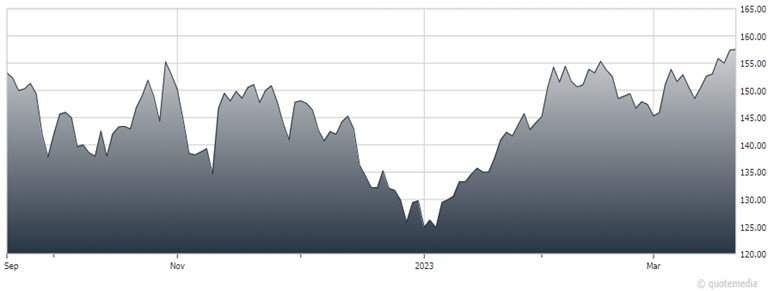

Apple Inc. (AAPL)

We think AAPL uses its ability to design and develop its own operating system, hardware, application software, and services to differentiate itself from competitors. Our “Buy” opinion reflects our view of AAPL’s ecosystem, high customer retention rates, and expanding addressable market.

Despite macro uncertainty, we think AAPL’s premium valuation is warranted given stable FCF generation, aggressive capital allocation strategy, and management’s ability to execute. We forecast further upside to average selling prices in the coming years (e.g., foldable phones), while ongoing growth within the installed base should keep services expansion intact (e.g., advertising, gaming, bundling).

Margins could offer upside ahead, on better mix and declining component prices. We like AAPL’s attractive pipeline, while switcher rates remain high. Our 12-month target of $165 is based on a P/E of 24.2x our CY 24 EPS estimate of $6.82, above peers.

We think an aging and growing installed base of +1 billion phones (+2 billion total devices) will allow AAPL to see growth and support greater penetration for the services business. Risks to our recommendation and target price include less success with product launches/innovations, longer-than-expected hardware replacement cycles, and regulatory scrutiny within its services business.

Recommended Action: Buy AAPL.