The Federal Reserve’s official communique after its last hike, as well as the tenor of chairman Jerome Powell’s subsequent press conference, was notably different from previous occasions. If not a pivot, it was a significant shift in policy – and it will impact several markets, comments Adrian Day, editor of The Global Analyst.

Two significant developments in March ushered in this shift: The failure of three U.S. banks and Credit Suisse. They show clearly that, after such a long period of excessively loose monetary policy, aggressive rate hikes will cause something to break. It would be fantasy to assume that no other financial institution is tottering on the brink.

And then the response of the Fed and other central banks was to do what central banks always do with any problem, namely, throw money at it. In 24 hours, the Fed undid almost half of all the Quantitative Tightening it had undertaken over the past year.

Again, it would be unrealistic to think they will not do this again. This dramatic shift comes before inflation is under control and as the economy slides into recession. The effect on the markets, particularly bonds, gold and the dollar, will be significant and long lasting.

Not surprisingly, bonds had a positive first quarter, the first in a long while, with longer-term bonds up 5% (including yields) and intermediate bonds up 2%, all of it in March as the sentiment turned heavily towards a pivot.

Most stock markets around the world moved up this year, continuing the move from last fall when markets began to anticipate a shift in Fed policy. The S&P rose 7% (the Nasdaq more than double that, the Dow barely positive, as tech roared back). International markets (outside the U.S.) were up just over 6%.

Meanwhile, underneath the headlines, the economy is deteriorating. The Fed has been less concerned, even wanting unemployment to move up. But the economy is heading to a recession. While corporate CEOs do not expect a serious downturn, small business owners are more pessimistic, as is the Leading Economic Index.

Overall, we remain cautious on global equity markets, seeing a downside risk that is not priced in. Our buying will be focused on quality high-dividend payers in the U.S.; the bluest of global blue chips; quality growth stocks in smaller markets; and opportunistic buys (including the selling of puts on depressed stocks).

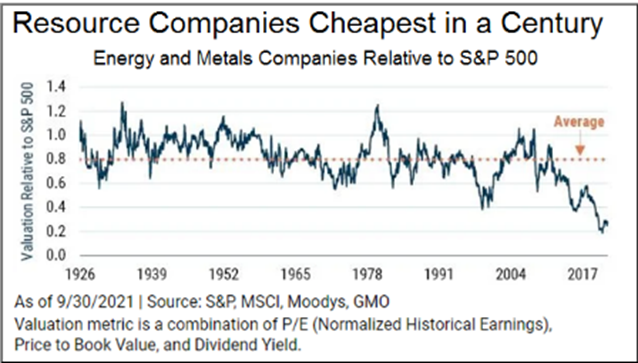

We are also overweight gold and other resources. Resource shares are the cheapest relative to the market in a long, LONG time.