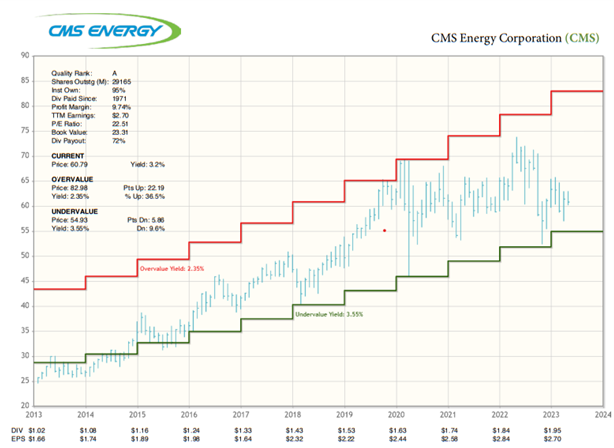

With the dividend yield of the Dow Utilities within eleven basis points of “Overvalued,” I find it interesting that some utility stocks are finding their way to the “Undervalued” category. As one of the more interest rate sensitive sectors, utility stocks historically have been an indicator for the direction of interest rates. Consider buying sector name CMS Energy Corp. (CMS), advises Kelley Wright, editor of Investment Quality Trends.

CMS is the energy holding company for Consumers Energy, a regulated electric and gas utility serving Michigan’s lower peninsula, and North Star Clean Energy, which is engaged in U.S. and international energy-related businesses.

CMS operates in three business segments: Electric utility, gas utility, and North Star. CMS’s electric utility operations include generation, purchase, distribution, and sale of electricity. The company’s gas utility purchases, transports, stores, distributes, and sells natural gas. The North Star segment, through its various subsidiaries and equity investments, is engaged primarily in domestic independent power production.

In June 2021, CMS Energy sold EnerBank, a Utah state-chartered, FDIC-insured industrial bank providing unsecured consumer installment loans to Regions Bank for $1.019 billion in proceeds. With the sale of EnerBank, CMS can focus more on its core areas of utility operations and services and improving the earnings and cash flow at its North Star segment.

The company plans to grow its rate base through capital expenditures of $14.3 billion from 2022 to 2026, with around 80% aimed at the regulated utility businesses and roughly 20% intended for clean energy generation, including wind, solar, and hydroelectric.

CMS has a goal of achieving net-zero carbon emissions by 2040. CMS Energy is headquartered in Jackson, Michigan and has paid dividends since 1971.

Recommended Action: Buy CMS.