The Economist called it like it is recently, pointing out that everyone—even some of the smartest folks in finance—has blown it with their forecasts in the last few years. The lack of clarity on the market’s near-term direction nicely tees up this pick: A 5.5%-paying (and 7.6%-discounted) municipal-bond fund called the Nuveen Municipal Credit Opportunities Fund (NMCO), argues Michael Foster, editor of CEF Insider.

To be sure, “muni” bonds—mostly issued by local and state and governments to finance big infrastructure projects—aren’t where most folks go for quick profits. But they are where we go for safe tax-free income that balloons when compared to taxable income, like stock dividends.

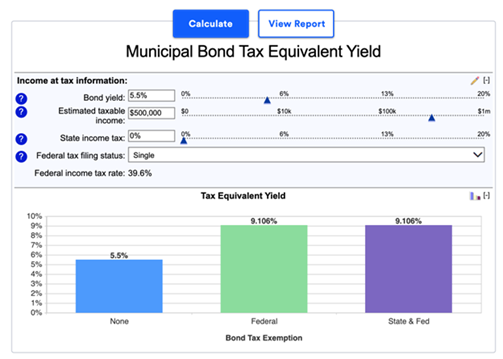

To see how big this difference can be, let’s plug NMCO’s 5.5% yield into Bankrate’s tax-equivalent yield calculator, which shows how much a muni bond’s yield can grow when compared to taxable income.

Source: Bankrate.com

As you can see, for the highest bracket, that 5.5% yield jumps to 9.1%. There’s a reason why the wealthy love munis, and it’s neatly summed up in this screenshot.

Some other details on NMCO: It’s a new CEF, launched in September 2019. As mentioned, it yields 5.5%, or a taxable-equivalent 9.1% for those in the highest bracket. And that’s before the fund’s yearly special dividends. Including those, I see NMCO’s yield hitting 10% on a taxable-equivalent basis (again for those in the highest bracket) for 2023.

You might wonder just how NMCO delivers that kind of payout.

The fund’s mandate is simple: It invests in all kinds of muni bonds, with 70% rated above CCC+ (junk rating) and 30% in the junk category. Its portfolio consists of munis with very specific terms, such as the District of Columbia Tobacco Settlement Financing Corp., one of the many cigarette-manufacturer settlements from the 20th century that’s still paying out cash to the government (and by extension to us through NMCO).

In other words, these investments have so much oversight, restrictions and regulations that it’s very difficult for them to lose money. Bear in mind, too, that fewer than 0.1% of muni bonds default, and even then, practically zero bondholders lose their whole investment.

Mathematically, then, NMCO’s worst case is that 0.1% of its 410 bonds default, and on average the fund would recover 52% of its initial investment in that 0.1%. So, we’re talking about 0.2132 bonds in NMCO’s portfolio potentially defaulting, for a max loss of 0.05% of net asset value (NAV).

Even the most paranoid investor would have to admit this risk is very low—yet NMCO trades at one of its largest discounts in five years, and close to its biggest discount during the pandemic!

Recommended Action: Buy NMCO.