The Federal Reserve just raised the target for its benchmark interest rate by 0.25% to a new range of 5%- 5.25%. This will impact the value and stability of the US dollar and stock markets in several ways. Meanwhile, the JPMorgan Equity Premium Income ETF (JEPI) is a good way to generate welcome income and provide diversification to reduce volatility, shares Carl Delfeld, editor of Cabot Explorer.

During the only stable dollar eras of the last century, annual GDP growth averaged 4.9% from 1922-29, 4% from 1948-71, and 3.7% from 1983-2000. In comparison, over the last two decades, a more volatile dollar saw average growth of only 1.9%.

Had the dollar remained stable since 2000, with a steady 3.7% growth, the economy would be nearly 50% greater than it is today, and we probably would have avoided all these financial crises along the way.

The US dollar has fallen about 8.3% from a peak in September, as tracked by the WSJ Dollar Index. Many are betting the US currency has further to fall as the Federal Reserve probably nears the end of interest rate hikes and concern grows about a recession.

A weaker dollar increases US exports, lowers the cost of US dollar debt for foreign companies and governments, and supercharges the value of overseas earnings by US multinationals.

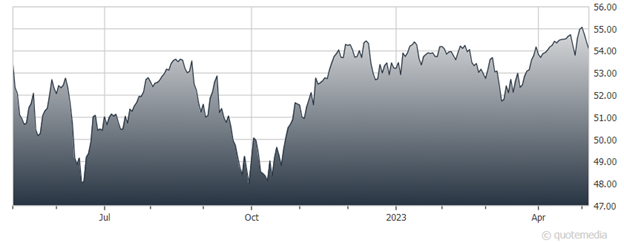

JPMorgan Equity Premium Income ETF (JEPI)

As for JEPI, it invests in defensive stocks and uses options strategies to generate income. It has been the most popular active ETF by a wide margin in 2023, bringing in $7.1 billion of new cash, according to FactSet.

This ETF also delivered a 12-month rolling dividend yield of 11.7% over the past year. It was launched in 2020 and has risen in popularity, roughly quadrupling its assets under management from $5.8 billion at the start of 2022 to $24.6 billion today.

This ETF’s double-digit yield comes from both option premiums and dividends. The fund invests in equity-linked notes (ELNs), a type of debt that provides returns linked to underlying instruments within the ELNs.

In JEPI’s case, these ELNs mimic the returns of an S&P 500 covered call strategy. The ELNs that JEPI owns convert the options premiums received into coupons that are distributed monthly. JEPI invests up to 20% of its net assets in these ELNs, though their weighting in the fund is usually around 15%.

Recommended Action: Buy JEPI