Apple (AAPL) reported a good March quarter. Revenues fell a less-than-expected 2.5% from last year to $94.84 billion, nicely above the $92.84 billion estimate. Earnings were the same as last year, $1.52, solidly above the $1.43 consensus, notes Michael Murphy, editor of New World Investor.

More in a minute. But first, let’s talk about the Federal Reserve.

The Fed in March said: “We anticipate that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

The Fed last week said: “In determining the extent to which additional policy firming may be appropriate to return inflation to 2% over time, the committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

I know that was a meaningful change because, in the press conference, Chairman Powell went out of his way to say it was. This headline captured the change: Not Quite Dovish, Not Quite Hawkish, the Fed Is ‘Don-ish’ With Hikes.

As they should be. Real GDP is barely growing. Manufacturing activity fell for the sixth straight month. The latest Job Openings and Labor Turnover Survey, or JOLTS report, showed 9.6 million job openings at the end of March, down from 9.9 million in February and the lowest level since April 2021. The Personal Consumption Expenditures Index is trending down.

This Wednesday’s headline Consumer Price Index is expected to be 4.4%, well below March’s 5.0%. Chairman Powell said: “We on the committee have a view that inflation is going to come down not so quickly. If that forecast is broadly right, it will not be appropriate to cut rates.”

Fine, dude. Just stop raising them and you just may get your soft landing in the form of a mild, short recession.

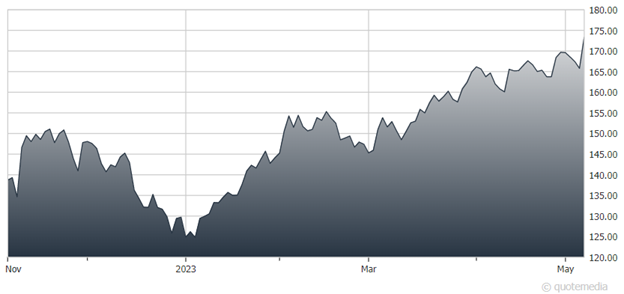

Apple Inc. (AAPL)

Meanwhile, on the AAPL conference call, management said iPhone sales rose 1.5% from last year in spite of the weakness in China to a March quarter record of $51.33 billion. As expected, Mac sales fell to $7.17 billion, down 31.3% from last year, and iPad sales fell 12.7% to $6.67 billion. Wearables, Home, and Accessories slipped 0.7% to $8.75 billion, but Services kept growing, up 5.4% year-over-year to a record $20.9 billion.

For the 11th year in a row, they also increased the quarterly dividend. It went up 4% to 24¢ and they added a whopping $90 billion to the stock buyback program.

Recommended Action: Buy AAPL, preferably under $150.