Our forecast for the average price of a barrel of West Texas Intermediate crude oil in 2023 remains $82, compared to last year’s average price of $95. We anticipate a trading range of $100-$65 for the year. Valero Energy Corp. (VLO) is a “Buy” in this environment, says John Eade, president at Argus Research.

The current price for a barrel of West Texas Intermediate, the crude oil benchmark grade, is around $70. That’s up from a low of $67 in mid-March but down from the $80 level reached in late January. We look for prices to move higher as the summer driving season approaches and China’s economy returns to full strength.

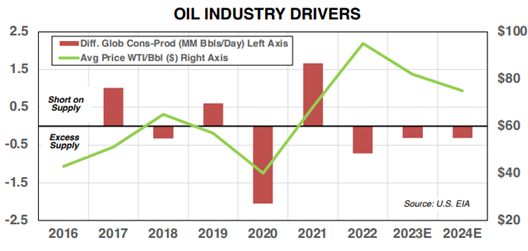

Oil prices were volatile last year, as the price per barrel ranged from $71-$121. We don’t look for as much volatility in 2023. The long-term core drivers behind oil prices are global demand and global supply.

According to the U.S. Energy Information Administration, there was excess supply in 2022: global consumption was 99.4 million barrels per day, while global production was 100.1 million barrels. Forecasts for the next two years call for supply to continue to outpace demand. If that’s the case, we expect to see oil prices drift lower.

Of course, there are always wild card developments, ranging from wars (Russia’s invasion of Ukraine) to sanctions (Iran, Venezuela). These can cause prices to fluctuate dramatically. But absent the wild cards, the global demand-supply outlook suggests the days of triple-digit oil prices are in the rear-view mirror.

As for VLO, it is the world’s largest independent petroleum refiner and marketer with total capacity of approximately 2.9 million barrels per day. We have a favorable view of the current refining environment, particularly heading into the historically strong, summer driving season.

We view VLO as the one of the best pure-play, large-cap names in the group thanks to its size, scale, and diversified portfolio. Valero also has a meaningful first-mover advantage in its Diamond Green Diesel (DGD) renewables business and is the largest producer of renewable diesel fuel. It is also working on carbon-capture projects for its ethanol plants.

Our target price on VLO is $162. The recent yield was 3.6%.

Recommended Action: Buy VLO.