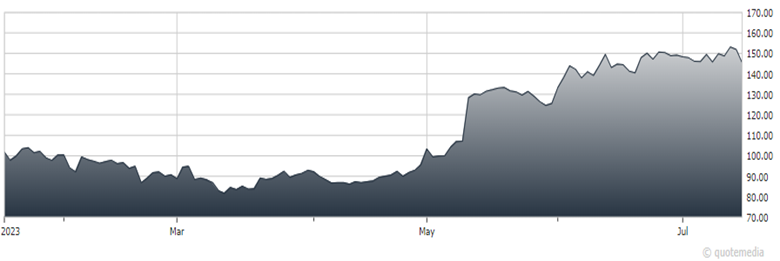

Editor’s Note: John Gardner, founder and principal of Blackhawk Wealth Advisors’ Market Insights, had the fifth best-performing recommendation from our annual “Top Picks 2023” Report through mid-year. The consumer beverage company Celsius Holdings (CELH) produced a total return of 52.7% during the tracked period. I reached out to him for updated commentary and guidance on his “Terrific Ten” stock, and this is what he provided...

Celsius has proven that it has no problem generating profits. In the first quarter of 2023, net income rose 413% year over year. Its ability to score big on top-line (sales) growth has also been incredible and should continue. Revenue of $654 million in 2022 was almost 800% greater than just three years earlier.

New sales channels such as colleges and universities are likely to lift revenue higher. A big boost to Celsius’ sales outside of the US should come from the recent distribution partnership it inked with PepsiCo. (PEP). In taking a page right out of Monster Beverage’s playbook, Celsius hopes to experience the explosive sales growth Monster gained from its partnership with Coke.

Celsius Holdings (CELH)

Simply, fantastic growth is a key reason that investors should consider buying the stock for both short-term and long-term growth.

Recommended Action: Buy CELH

Subscribe to Blackhawk Wealth Advisors’ Market Insights here...