Everyone has been celebrating the recent inflation numbers. Indeed, all we hear is good news that the Fed is winning the war against rising prices. But are you feeling that supposed victory in your daily life? I suspect the answer is no. That’s why you should continue to focus on inflation-fighting investments like EOG Resources (EOG), suggests Nilus Mattive, editor of Safe Money Report.

You’ve probably heard the old apologue about frogs in a boiling pot of water — the one where the poor amphibians don’t notice the ever-rising temperature of the liquid around them until it’s too late. Well, inflation works a lot like that, too.

Inside the government’s alphabet soup of flawed inflation measures is a basic truth: We almost never experience true deflation where prices for goods and services actually drop. Instead, we have ever-increasing amounts of inflation affecting what we buy day in and day out.

So, when the mainstream media says inflation is cooling, they simply mean the rate of inflation isn’t going up as fast as it was before. In other words, even when the Fed is “succeeding,” the temperature is rising 2% a year! And right now, it’s going up far faster than that.

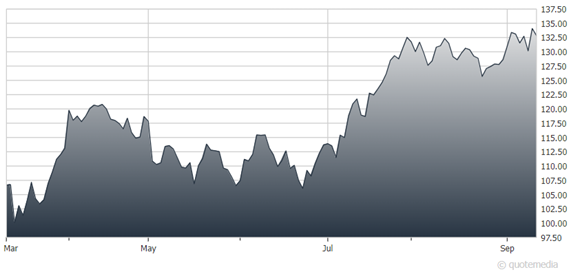

EOG Resources (EOG)

What’s more, the effects compound over time. Thus, even a short string of above-average inflation leads to substantially higher prices in a hurry. You need only look at the past several years to see how devastating all this is. Even using the government’s own flawed CPI data, something that cost $100 in 2018 now costs $121 today.

That’s a huge loss of your purchasing power over the past five years. And I don’t believe the current inflation beast has been truly tamed yet…which means it’s absolutely critical that we continue to protect our wealth through investments that produce solid, growing income streams as well as other alternative assets that can continue to outpace the actual price rises taking place in our economy.

EOG is one example. It was recently upgraded by our Weiss stock ratings to a “B-“ rating. One of the major factors was an increase in the company’s total capital. As noted recently, the company has been beating estimates and growing its bottom line. Shares are starting to respond to these great results too, with surging prices recently.

Recommended Action: Buy EOG.