Everything is in interpretation. One great example of this is when Kentucky Fried Chicken started expanding to China in the 1980s. They tried in earnest for a literal translation to Mandarin of their famous slogan: “It’s Finger Lickin’ Good!”, but instead it came out more like “Eat Your Fingers Off!” That doesn’t exactly scream ‘delicious’…unless you’re a cannibal, writes Jason Bodner, editor at Navellier & Associates.

My point is that two different perspectives can interpret the same data with two different meanings. Stock market analysis is the same. Oftentimes the mainstream hears “Eat Your Fingers Off!” when I am hearing “Finger Lickin’ Good!”

I’ve harped on the media’s penchant for doom and gloom so often that I must sound like I’m constantly repeating himself. I may sound like a broken record, but I don’t really blame the media. We humans are a funny breed – we’re attracted to negative stories because counterintuitively, it makes us feel better about ourselves. Since the 1850s, Germans called this Schadenfreude, literally finding joy in others’ misfortune.

Our current news cycle is dominated by hurricanes, auto-union strikes, political scandal, inflation, war, and even click-bait headlines like Mexican Congress’ hearings on 1,000-year-old aliens. It’s a drag!

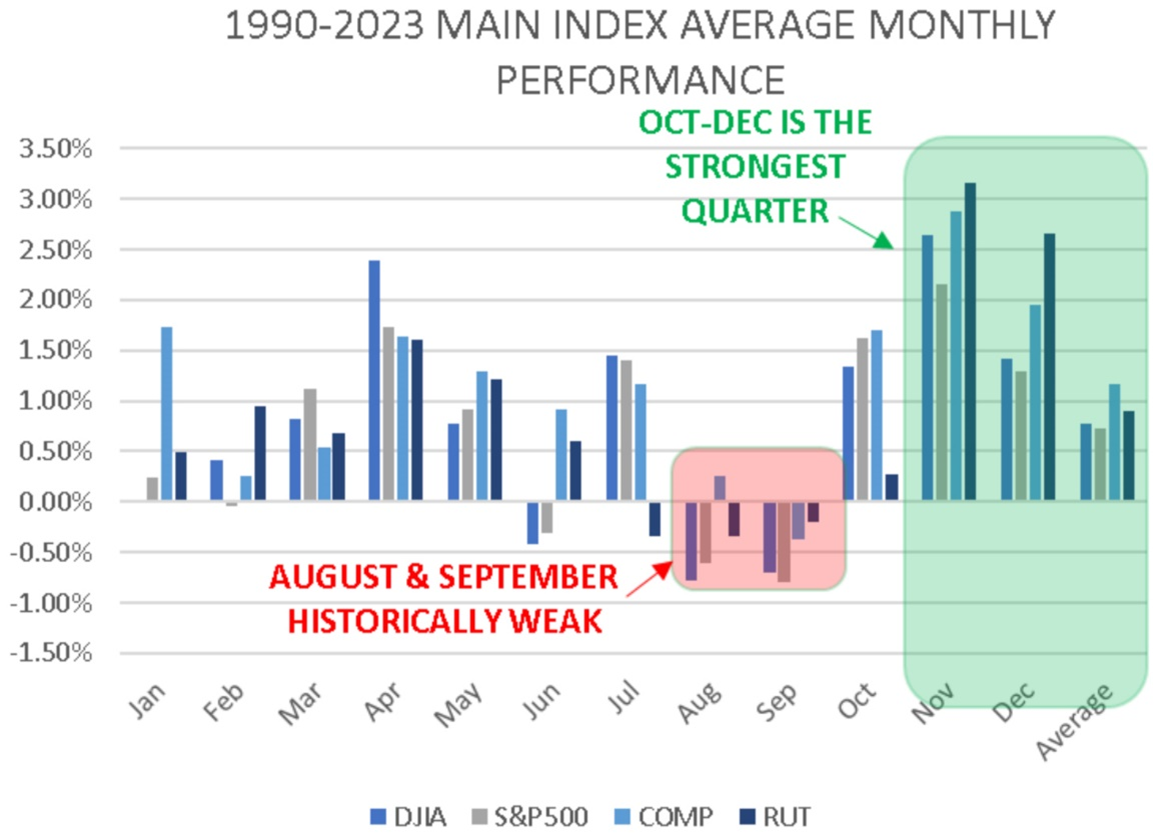

The stock market tuned into the news, with a lame September thus far. Historically speaking, August and September are the worst two months of the year for stocks, so stocks aren’t really underperforming – they’re actually just doing what they usually do. In other words: we must wait out the usual volatility.

The good news is that October through December is historically the strongest time of year for stocks, with substantial positive performance. The major story for investors remains pesky inflation and the difficulty to wrangle it under control. The Fed continually references its long-term goal of 2% inflation as a healthy level.

Let’s look at that for a moment: When Fed Chairman Jay Powell speaks, maybe the world hears him saying, “Eat Your Fingers Off,” but I am hearing something else. First, inflation has fallen over 6% from its peak. Currently it sits at 3.7% in the latest reading of the Consumer Price Index. Yes, that’s a meaningful uptick from June’s reading of 3%. But even a shallow look beneath the surface reveals that energy is the main culprit.

However, the energy categories are still down substantially for the past year. Utilities, used cars and trucks, and medical care services are also down for the last 12 months. Energy and food costs are volatile, which is why there is “core” CPI that omits those line items.

When energy and food are removed from the equation, all items rose only 0.3% in August. If you account for problems related to the shelter inflation measure, you see we’re in even better shape.

Yes, September volatility is here. News headlines will take every advantage to leverage attention. But then again, that’s what we expect this time of year. That only paves the way for Q4: a big lift!

I believe inflation isn’t as bad as the media echo chamber. I also believe we will not fall into a recession and stocks will lift by year’s end. Is it “Finger Lickin’ Good?” or “Eat Your Fingers Off”? I guess it depends on who is looking.