I have good news and bad news for you. Which do you want to hear first? Apparently, it matters which one you hear first. According to one psychological study, people who get the bad news first end up in a better mood after hearing both. Those who get good news first aren’t likely to be encouraged in the end, writes Jason Bodner, editor at Navellier & Associates.

So, bad news first then? We might not be out of the woods just yet. September was an ugly month for the market with the S&P troughing down 4.9% from August’s close, and Nasdaq down 5.8%. Most would say, “Okay, that’s over! Thank you!”

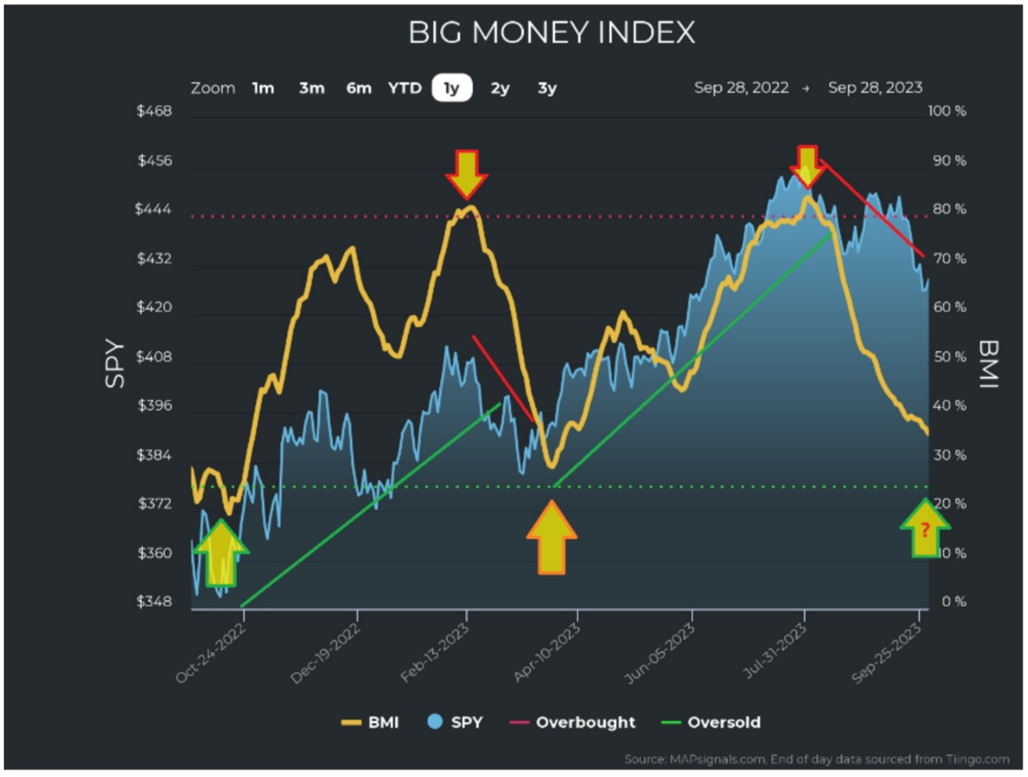

But based on the latest readings from the Big Money Index (BMI), the storm might not have passed just yet. Having a good October doesn’t mean the good news starts on the first day of October. We didn’t bottom out in the S&P 500 until the 12th day of October last year.

The BMI on September 28th was 35.7. The bad news is that it is still falling. As sellers have taken control, and buying has waned, the BMI has unsurprisingly fallen. And it continues to fall.

That said, September is over, and October through December are contributors to the best quarter for stocks. Another reason why a near-oversold BMI is good news is because, if you’re familiar with the BMI, you’re familiar with what a powerful forward indicator it is – especially when it hits oversold levels.

Forward returns are significantly higher by an astonishingly high percentage of the time after the BMI goes oversold. We see this in the past 12 months, below. When the BMI goes oversold – markets tend to zoom thereafter.

Yet, while we look to the future, we shouldn’t ignore the present. There has been some wicked selling going on lately. There has been only one real bright spot: Energy. On the flip side, all other sectors are feeling the burn. Utilities and Real Estate, in particular, are getting clocked.

As the season turns the page into fall and winter, I expect a strong, tech-led rally with concentrated buying in the small- and mid-cap regions, likely starting in November. But I live by data. The data says we are in a BMI downdraft which means possible near-term pain and then multi-month gain.

So, now is the time to start identifying deals you may want to take advantage of. While there are no guarantees in life, the landscape is tilted asymmetrically in favor of price appreciation in the near future. That’s not only rare, but it’s reliable and accurate.

Don’t let the bad times scare you or ruin your day. Each day we are here is a good one!