As Treasury yields climb to 16-year highs amidst expectations that the Federal Reserve will maintain higher interest rates for an extended period, investors are exploring strategies to weather the volatile financial landscape. Amid the current backdrop, I used the InvestingPro stock screener to identify top-quality stocks that offer growth potential in a higher-yield environment. One of them is Altria Group (MO), writes Jesse Cohen, senior financial analyst at Investing.com.

The yield on the US 10-Year note rose as high as 4.8% recently, a level not seen since 2007. Looking ahead, I expect the 10-year yield to establish a new, higher range in the weeks ahead, potentially topping the 5% handle in response to the Fed's hawkish longer-term rate outlook.

While rising yields can present challenges, they also create opportunities, especially in specific sectors and stocks known for their resilience and income potential. Amid the current backdrop, I used the InvestingPro stock screener to identify top-quality stocks that offer growth potential in a higher-yield environment.

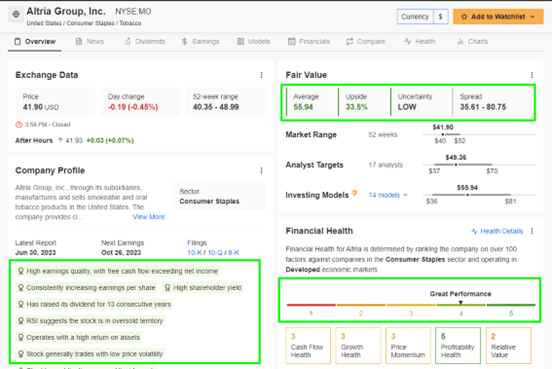

I first scanned for stocks with a dividend payout yield of at least 5% and a dividend growth streak greater than or equal to five years. I then filtered for companies with potential upside of at least 15% based on both InvestingPro ‘Fair Value’ models as well as Wall St. analyst price targets.

And those companies with a market cap of $50 billion and above made my watchlist. Once the criteria were applied, I was left with a total of just five companies. One of them is Altria.

Altria Group

- Sector: Consumer Staples

- Dividend Yield: 9.36%

- InvestingPro Upside: +33.5%

- Analyst Upside: +18.1%

Why It's Attractive: Altria's strong dividend history, combined with its substantial dividend yield, has long made it an income investor's favorite.

The cigarette manufacturing company has proven over time that it can provide investors with higher dividend payouts regardless of the economic climate. Indeed, Altria has raised its annual dividend for 54 years running, earning it the prestigious title of ‘Dividend King’.

Source: InvestingPro

Recommended Action: Buy MO.