Closed-end funds (CEFs) are ready to climb after a two-month decline. In preparation, some investors are buying funds that feature convertible bonds. But I'd favor the fixed income category that everyone hates – and buy Nuveen AMT-Free Municipal Credit (NVG), says Brett Owens, editor of Contrarian Income Report.

Convertible bonds pay regular interest. In this way, they act like bonds. You buy them and “lock in” regular coupon payments. But convertibles are also like stock options in that they can be “converted” from a bond to a share of stock by the holder. So, you can think of them as bonds with some stock-like upside.

Investors have been piling into funds that invest in them, including the SPDR Barclays Capital Convertible Bond ETF (CWB) and Calamos Convertible and High Income Fund (CHY). But a better bet is NVG.

Next to US Treasuries, muni bonds are the safest bonds in America. And lately, munis have been comparative darlings! No debt drama for these boring payers.

Munis are usually so mundane and reliable that they rarely go on sale. And here’s a great thing about municipalities, at least for us investors: When they need money, they issue bonds. The writers of muni bonds are not interest rate sensitive.

Which means muni funds are the place to be right now. Or at least soon. But you wouldn't know it from their valuations. In contrast to convertible-powered CHY, boring 'ol NVG trades at a 16% discount to its NAV today.

A 16% Discount Window, Wide Open

Yup! This well-run muni fund is on sale for 84 cents on the dollar. Buy the stock for under $10, receive $1.85 in NAV for free.

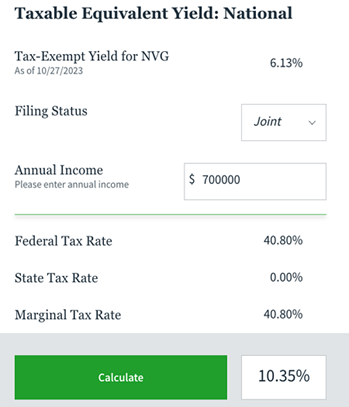

And oh by the way, the fund just raised its monthly payout by 19%! The fund dishes 6.1% and on a tax-exempt basis, it’s even better. For my top tax-bracket ballers, this is a tax equivalent yield of nearly 10.4%:

Meanwhile, this tax-advantaged dividend comes with not one, but two, margins of safety:

- The 16% markdown. As this discount narrows, the fund will enjoy price upside.

- Plus, NAV gains are likely when interest rates settle down.

Yes, NVG is positioned to be a special taxpayer trifecta. The US economy is slowing down en route to an eventual recession. Which means long rates will eventually trend lower.

That move will push cheap munis like these much higher. Not bad for supposedly boring bonds! It's a great time to hop aboard the slow, steady, and dirt-cheap muni train - before our income friends park their high-flying, overpriced convertibles and head this way.

Recommended Action: Buy NVG.