The unanimity at the Fed has been applauded by many in the media. Group think appears to be “in.” General George S. Patton would disagree, as he said: “If everyone is thinking alike, then somebody isn’t thinking,” counsels Nancy Tengler, CIO at Laffer Tengler Investments.

When a group of individuals inside the Beltway enthusiastically agree, we who live in the real world should pause. Since I began writing this piece (Okay, okay. Christmas shopping took a bite out of my time), the Fed Chairman held his press conference where the market heard a DOVISH pivot and rallied hard.

Then the Fed Governors emerged one by one to say: “Hold on, we are not easing just yet.” This has been the pattern. The Chairman speaks and is interpreted by investors, then the clean-up on aisle seven, followed by a unanimous vote at the next meeting. Is it any wonder the market has stopped listening and taken the rally in stocks and bonds into its own hands?

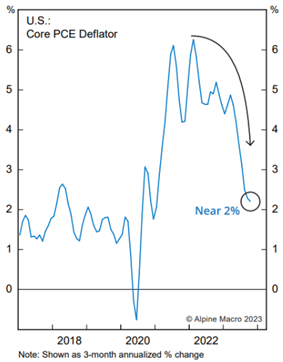

Using the Fed’s preferred measure (see chart here), the Fed’s own target is within reach. This does not change, of course, the deleterious effects of embedded inflation.

Using the Fed’s preferred measure (see chart here), the Fed’s own target is within reach. This does not change, of course, the deleterious effects of embedded inflation.

Pundits, politicians, and investors focus on the rate of change but that does not match the experience of American consumers who are still paying 18% to 20% more for just about everything. As inflation slows, though, real prices will decline. And some areas of the goods market are downright deflationary. That will help the average American’s pocketbook.

US labor costs are also down significantly, thanks in no small part to a massive improvement in productivity (Read: The results of technology spending). Importantly, wage gains combined with productivity improvements are not inflationary.

In summary, the rate of change in overall inflation has come in. The question for investors is will the sticky inflation finally roll over?

Sometimes it is right to be wary, cautious, even skeptical. I just don’t think that time is now. The current geopolitical and economic environment feels a great deal like the 1990s to me. And not only was I alive then, but I was investing billions of dollars' worth of institutional, mutual fund, and private client assets.

Lest I be accused of being a perma-bull, allow me to remind that in February of 2020 with concerns about an overvalued market, we added a hedge to our portfolios. We simply could not find high-quality, attractively valued companies for purchase. That was then.

Today, given the sharply concentrated performance of the cap-weighted S&P 500 (Read: The Magnificent Seven), we are finding interesting companies at attractive valuations with growing earnings and experienced management teams.

As we have written countless times, we believe technology companies (not all, but in general) are the new defensive names. We always want to own reliable earners in a slowing economic environment. Additionally, we believe there is a secular tailwind that will drive technology earnings for many years to come.