Earlier this month, we highlighted 2024’s first big merger of oil and gas producers: Chesapeake Energy’s (CHK) long-rumored, all-stock purchase of Southwestern Energy (SWN). Now we have the first big midstream deal of the year. Energy Transfer LP (ET) is by far the most attractive play on this transaction, suggests Elliott Gue, contributing editor of Energy and Income Advisor.

Fuels retailer Sunoco LP (SUN) is offering 0.4 of its shares per partnership unit of pipeline and fuel storage company NuStar Energy LP (NS). ET is Sunoco’s general partner and owns 33.86 percent of its common shares. That makes it the central player in this deal, just as it has been in six other major midstream acquisitions the past two years-plus. And this time, it’s using an affiliate’s shares as currency, avoiding both dilution and balance sheet concerns.

Sunoco accounted for roughly 7.3 percent of Energy Transfer’s cash flow in Q3 2023. And that percentage should go meaningfully higher following the expected close of the NuStar acquisition expected in Q2 2024—thanks to estimated three-year distributable cash flow accretion of 10 percent for Sunoco.

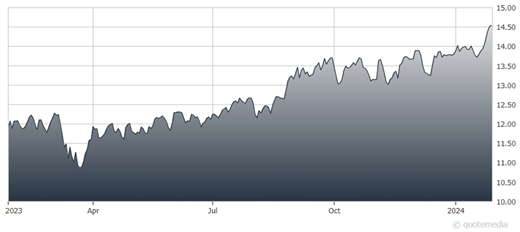

Energy Transfer LP (ET)

As general partner, Energy Transfer is the best way to play this deal. It’s still a buy up to our highest recommended entry point. Under the terms of the deal, NuStar shareholders will absorb an immediate tacit dividend cut of about 16%. That’s more than made up for by the premium paid, but NuStar is a hold. So is Sunoco, which is simultaneously selling 204 convenience stores for roughly $1 billion.

At this point, there’s little question we’re going to see more energy deals announced this year. And while there’s a growing possibility that US regulators will demand some conditions for approval, the resulting companies will be stronger and more resilient, as will North American shale generally.

Outside of sector M&A, energy companies’ Q4 results and updated guidance for the coming year are the other big business story to keep an eye on now. So far, companies reporting have turned in solid operating numbers, with management maintaining focus on rewarding shareholders and strengthening balance sheets.

Recommended Action: Buy ET.