American Financial Group (AFG) is an insurance holding company that is engaged in property and casualty insurance, focusing on specialized commercial products for businesses. In business for over 150 years, this $10 billion market cap company has regularly increased its quarterly dividend since 2006, explains Ben Reynolds, editor of Sure Dividend.

AFG reported Q3 2023 earnings on Nov. 1. For the quarter, earnings per share equaled $2.09, which is above the $1.93 per share that the company reported for the same period in 2022.

The company achieved an annualized core operating return of over 18% in the quarter, with strong underwriting results despite elevated catastrophe losses during the quarter. American Financial Group had approximately $660 million of excess capital as of Sept. 30, and management intends to deploy that capital into the company’s core business as well as returning it to shareholders directly via share buybacks and dividends.

The company has confirmed earlier guidance for full-year 2023 earnings of $10.15 to $11.15 per share, reflecting the expectations of a below average crop year, offset by higher-than-previously expected net investment income. We are forecasting $11 in earnings per share.

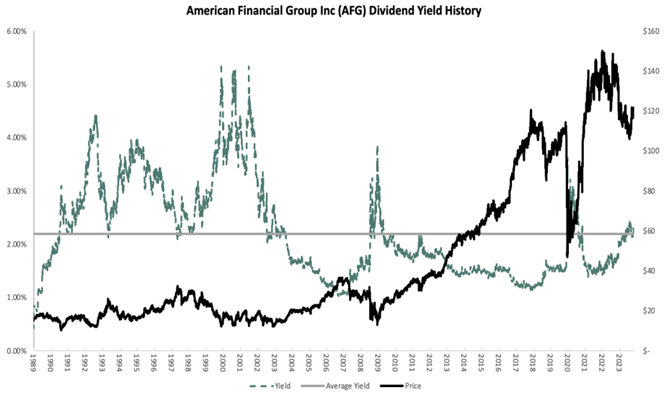

American Financial Group pays a $0.71 quarterly dividend. In addition, the company regularly pays “special” dividends. Special dividends per share totaled $5.50 in 2023 and $12 in 2022.

Insurance companies are stable, non-cyclical businesses with generally reliable revenue and income streams that allow them to pay consistent dividends and return capital to shareholders. American Financial Group fits this mold precisely, and its performance over the past decade shows consistently growing revenues and earnings.

We expect earnings to grow 8% annually. Shares are trading at 10.9 times our earnings estimate for 2023. Our fair value multiple is 13.0 times earnings, implying the potential for a 3.5% annual tailwind from the valuation.

Combined with the 2.2% yield and 8% growth forecast, annual total returns could be 13.5% through 2028. Notably, this return estimate does not include the likely payment of special dividends.

Recommended Action: Buy AFG.