American Outdoors (AOUT) was spun off from Smith & Wesson Brands (SWBI) in August 2020. The company has two divisions: The Outdoor division sells camping, hunting, fishing, outdoor cooking, and other outdoor activities products, while the Shooting Sports Division makes products such as targets, shooting clays, reloading equipment, and tactical and survival gear, explains Tim Melvin, editor of Takeover Letter.

American Outdoors does not make firearms or ammunition. It does, however, make almost every imaginable line of firearm accessories. It has set a target of doubling sales over the next four or five years to more than $400 million.

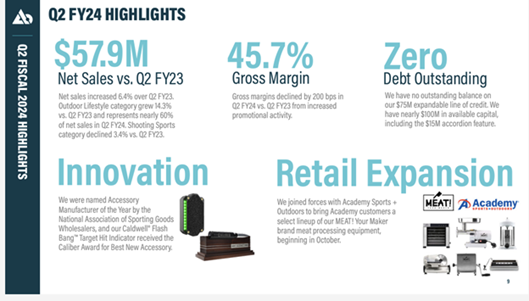

The company has no debt and trades for just 80% of its tangible book value. American Outdoors has been aggressive about reducing debt and has excess liquidity to deal with almost anything the economy can throw at it in 2024. The stock trades at less than 60% on the dollar of sales and just six times free cash flow right now.

The American Outdoors board also authorized a $10 million stock buyback in October. Over the last year, American Outdoors has reduced its share count by about 1.6%, so management is actively buying back shares. The stock is worth more than twice the current price in a buyout.

Recommended Action: Buy AOUT.