The S&P 500 touched 5,000 as I expected it would. Hooyah! I do feel sorry for the permabears, though; it must be tough to be so consistently wrong for so long. As for Nvidia (NVDA), to hear Wall Street tell it, the game is over. Right, says Keith Fitz-Gerald, editor of 5 With Fitz.

Think about what the bears have missed:

- Palantir Technologies (PLTR) has tacked on 198.18% over the past year.

- Nvidia has returned 213.78% over the same time frame.

- Heck, even the S&P 500 ETF Trust (SPY) has put on 23.19%... the SPY!!!!

Being “in to win” has never looked better.

Nvidia (NVDA)

As for NVDA? The bearish narrative is: China makes up 20% of data center sales, Advanced Micro Devices (AMD) is mounting a charge, and the stock is too “expensive” whatever that means.

Right.

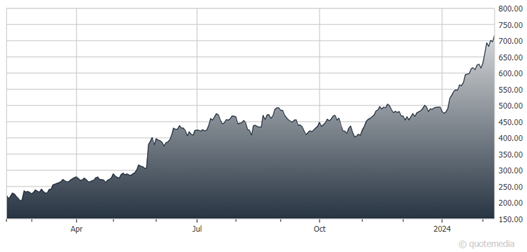

That’s what they’ve been saying since October 2022 when the company dropped all the way under $110 a share and many were ready to bin it. I told you NVDA was a buy. The stock has returned 462.41% since and was recently trading around $707. I continue to think NVDA splits, perhaps this year.

Repeat after me.... AI is the single largest investing theme in recorded human history. Many investors are making a critical mistake right now by thinking about AI as “just” another technology. AI will change the course of our world for generations. Big tech stocks, including many names we talk about frequently, will lead the way for decades.