Small caps have had a volatile week, which we can blame on the CPI inflation report (Tuesday) and subsequent move in interest rates. That all said, if you just woke up from a two-week nap you wouldn’t notice much at all at the small-cap index level. Meanwhile, EverQuote (EVER) is our newest addition and continues to look fantastic, notes Tyler Laundon, editor of Cabot Small-Cap Confidential.

The small-cap index is actually a touch higher than it was on January 30 and recently challenged the levels seen last Friday (pre-CPI report). That’s all a long-winded way of saying the market has digested the CPI report and determined (for now) that one slightly higher-than-expected reading doesn’t make a trend. It’s helped that a few Fed officials have said the same.

There is plenty of macro stuff we could talk about. But with the heart of earnings season for our portfolio stocks set to launch next week, I’m keeping the high-level talk short and sweet and focusing on our stocks. Get ready for the fun to begin!

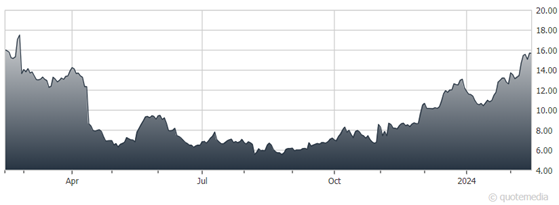

EverQuote (EVER)

EVER’s earnings will be out soon. I listened to the conference call from NerdWallet (NRDS) after it reported since that company also plays in the lead gen insurance market. That management team had very positive things to say about their outlook for carriers to increase spending on customer acquisition in the auto insurance market.

They also mentioned how Q1 2024 will be a tough comparison to the same quarter last year because everybody thought the auto insurance market was going to recover (i.e., Q1 2023 was pretty good) but ultimately didn’t. I’m expecting some of the same from EverQuote’s team, but also expect this dynamic is factored into the stock. Elsewhere, Progressive (PGR) stock continues to do extremely well (one of EverQuote’s biggest customers).

Recommended Action: Buy EVER.