Comcast Corp. (CMCSA) is a media, communications, and entertainment conglomerate. The whole cable industry is being impacted by the cord-cutting trend. But consumers still need Internet service for streaming, and Comcast has so far been able to withstand this trend through growth from its other businesses, writes Nikolaos Sismanis, analyst at Sure Passive Income.

Comcast was founded in 1963, generates $121 billion in annual revenue, and trades with a market capitalization of $166 billion. Comcast reported its Q4 2023 results on Jan. 25. For the quarter, the company’s revenues climbed 2.3% to $31.3 billion, adjusted EBITDA (a cash flow proxy) was essentially flat, rising 0.1% to $8 billion, and adjusted earnings-per-share (EPS) climbed 2.4% to $0.84. The firm generated free cash flow (FCF) of $1.7 billion.

As of the fourth quarter of 2023, Comcast reports results for two key business segments: Connectivity & Platforms (Residential Connectivity & Platforms and Business Services Connectivity) and Content & Experiences (Media, Studios, and Theme Parks).

The Connectivity & Platforms segment’s revenues rose by 0.5% to $20.4 billion and adjusted EBITDA growth was 3.1% to $7.6 billion, helped along by adjusted EBITDA margin expansion of 1.3% to 37.1%. The Content & Experiences segment saw revenue growth of 5.7% to $11.5 billion, and its adjusted EBITDA rose 2.3% to $932 million.

During Q4 2023, Comcast repurchased $3.5 billion worth of common stock at around $42.74 per share. We believe Comcast will remain a healthy, solid, dividend-paying company. We have increased our earnings per share estimate to $4.26 for 2024 due to the ongoing share buyback program.

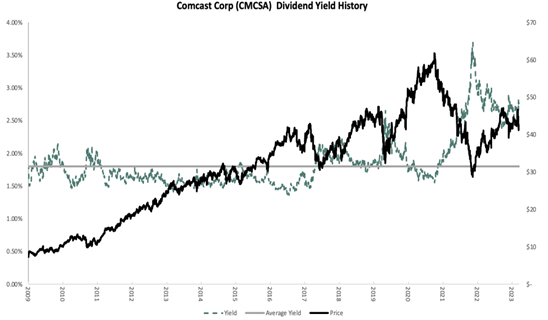

The stock recently featured a 3% dividend yield. The dividend payout ratio using expected 2024 earnings is 29%, making the payout very safe. In addition, Comcast recently authorized a new $15 billion share repurchase program, with no expiration date. We see modest revenue growth, small margin increases, and sizable share repurchases driving strong EPS growth.

Recommended Action: Buy CMCSA.