Investors are closely monitoring Federal Reserve Chair Jay Powell’s updates on the Fed’s monetary policy approach AND preparing for the February employment data that will be released on Friday. In the meantime, I like SLR Investment Corp. (SLRC) as a buy, explains Bryan Perry, editor of Cash Machine.

Both events and some negative news surrounding three of the not-so-Magnificent Seven – Apple (AAPL), Alphabet (GOOGL), and Tesla (TSLA) – are giving investors a reason to lighten up on some big-cap tech exposure. But there is strong rotation in other market sectors, namely industrials, materials, and non-bank financials.

This is a very healthy development for the bull market to extend higher while providing confirmation that the economy is on better footing than most market strategists were forecasting. The current estimate of the economy growing at around 3% for the first quarter supports the base case, a market that can rally by another 8%-10% by year’s end.

But not without days like Tuesday, when some air came out of the Artificial Intelligence (AI) balloon, and deservedly so. The great majority of the Cash Machine model portfolio is trading very well against a market landscape that has seen bond yields back up.

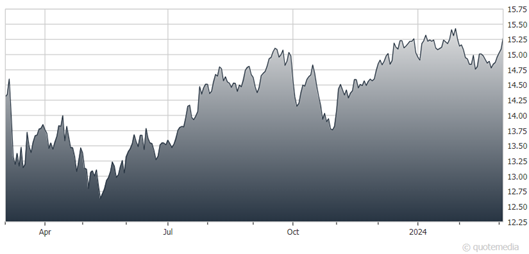

SLR Investment Corp. (SLRC)

The blended portfolio is more geared toward an economy that will continue to expand at a slow pace, with interest rates staying higher for longer. I just don’t see the Fed being in any kind of rush to cut rates, but we’ll all get more color on this soon.

As for SLRC, it just posted Net Investment Income (NII) of $0.44 per share, beating estimates by $0.01. Revenue of $59.59 million beat by $0.12 million as 2023 loan originations reached a record high. It was the fourth straight quarter of NII growth with the Net Asset Value (NAV) climbing to $18.09 per share.

SLRC made $449.8 million in investments during the quarter versus $346.3 million in Q3. Investments prepaid and sold during the quarter amounted to $462.1 million versus $306.8 million in the prior quarter. The company declared a $0.41-per-share quarterly dividend.

Recommended Action: Buy SLRC.