The market rally is forging ahead and making fools of the doubters, despite the Tuesday pullback. The S&P 500 was recently up 20% since late October and 7.5% so far this year. I continue to think Enterprise Products Partners LP (EPD) is a “Buy,” writes Tom Hutchinson, editor of Cabot Dividend Investor.

The main market driver is technology. The largest of all S&P sectors was recently 12.5% higher YTD. It is being driven by renewed excitement in the Artificial Intelligence (AI) space and a rebound in the cyclical semiconductor industry. But many other sectors have delivered solid performance YTD as well because the rally has broadened.

It is likely that investors will not get the interest rate cuts they are currently expecting. Inflation is down but it’s not out. This rally will likely end when investors come to the realization that those rate cuts aren’t coming, at least at the speed and extent currently expected.

Stocks got a taste on Tuesday as stocks sold down after one of the Fed presidents said he sees just one rate cut this year. But the current rally could go on longer. And most of your portfolio stocks are reaping the bounty.

Enterprise Products Partners LP (EPD)

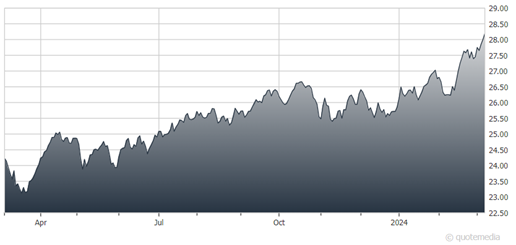

As for EPD, the midstream energy partnership is within pennies of its 52-week high after a solid earnings report. The company should deliver solid growth this year, with anticipated steady hydrocarbon demand and $3.5 billion in recent growth acquisitions coming online.

EPD has produced solid and steady returns in different market environments, with a 17.4% return in 2023 after a strong bear market return of 15% in 2022. Its massive distribution is extremely well supported and the stock is still well below the all-time high despite much higher earnings. There is a good chance EPD delivers another solid year in 2024. Its recent yield was 7.2%.

Recommended Action: Buy EPD.