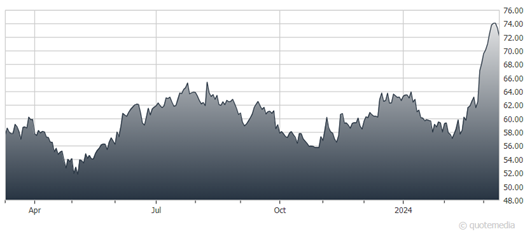

So far in 2024, the Dow Jones Utility Average lags the S&P 500 by nearly 10 percentage points. But over the past month, buying interest has picked up for at least a handful of portfolio companies. Southwest Gas Holdings (SWX) shares are up 30 percent in the past month, and it remains a buy on dips, advises Roger Conrad, editor of Conrad’s Utility Investor.

I continue to believe utilities as a sector won’t really capture upside momentum until there’s a genuine Federal Reserve pivot to lower interest rates. And with the central bank reactive as ever to the latest data point, investors have no choice but to be patient.

But with all but a handful of calendar Q4 earnings in for my 172 Utility Report Card members, it’s equally clear that utilities’ underlying businesses are booming. Not only did the vast majority of companies we track meet or beat 2023 guidance, but not one cut its longer-term guidance. Most actually raised the capital spending behind earnings growth.

Southwest Gas Holdings (SWX)

SWX’s gains follow updated guidance for 10% to 12% annual earnings growth at its regulated utilities through 2026, nearly double previous expectations. That reduces the risk of a substantial dividend cut later this year when the construction unit Centuri is spun off.

Centuri posted 2023 revenue growth of 5% and raised EBITDA margin to 9.7% from 8.3% a year ago. That belied concerns of business weakness and boosts odds of a strong spinoff valuation.

Southwest operates in some of the country’s fastest-growing regions, with regulatory mechanisms that basically lock in higher earnings from customer growth and system expansion. Centuri’s results indicate it’s having no problem securing utility infrastructure business. And it’s in prime position to capture a big slice of offshore wind project revenue, with Northeastern US states again showing commitment to the resources.

Recommended Action: Buy SWX on dips.