I just returned from a 10-day Forbes cruise in Asia (Indonesia, Singapore, and Vietnam) and am suffering some jet lag. But I have to ask: Who would have thought that on April 1, 2024, following a two-year, tight-money policy, two major foreign wars, and reckless deficit spending, we would witness new highs in both stocks and gold? I like the SPDR Gold Shares (GLD) and Global X Uranium ETF (URA) here, observes Mark Skousen, editor of Forecasts & Strategies.

As for the economy, the federal government (the Bureau of Economic Analysis) released its third estimate of real gross domestic product (GDP) growth recently at 3.4% (annual rate) for the final quarter of 2023, and 2.5% for the full year.

But the Bureau of Economic Analysis also released gross output (GO), which is a much broader measure of total economic activity, including the all-important supply chain, and it tells a different story. Real GO was a full percentage point below GDP in the fourth quarter, 2.4%.

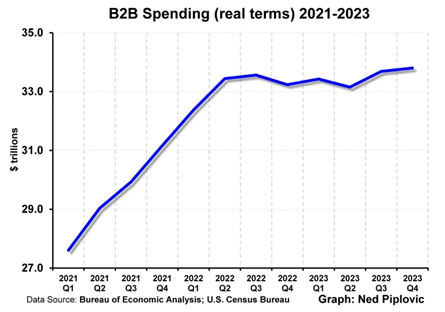

Worse, business-to-business spending actually fell slightly, by 0.3%…and has been virtually flat since the start of 2022, as this chart shows.

GO and business spending are leading indicators, suggesting a slowdown and perhaps even a recession in 2024.

Meanwhile, several of our other positions are moving in the right direction. Gold is one of them, now over $2,200 an ounce. GLD is up more than 8% year to date, and this despite a strengthening dollar!

Uranium prices are also starting to move back up, recently at around $88 a pound. The correction seems to be over. I recommend the URA. It’s ahead 7% so far this year.

Recommended Action: Buy GLD and URA.