Apple Inc. (AAPL) is down more than 13% this year due mostly to demand concerns in China, which are widely known. What is not yet in the stock, but will be soon, is how far along Apple is in integrating AI into its devices, advises Michael Murphy, editor of New World Investor.

I expect major announcements on AAPL’s progress with generative Artificial Intelligence at the Worldwide Developers Conference in June, followed by an AI-based iPhone 16 announcement in September.

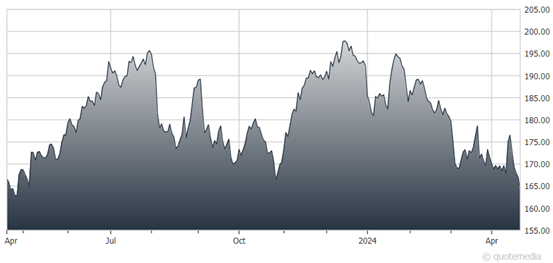

Apple Inc. (AAPL)

Bloomberg reported that Apple will focus the next version of its M-family of processors, the M4, on artificial intelligence to boost Mac sales. The M4 is already nearing production and will eventually be put into every Mac, with announcements to come as soon as this year.

Apple will give new iMacs, MacBook Pro, and Mac Minis the new chips. Market research firm IDC said Apple shipped 4.8 million Macs during the March quarter, up 14.6% year-over-year. It held 8.1% of the global PC market as of the end of March, up from 7.1% in the year-ago period.

Needham cut their estimates for the March quarter, citing weakness in the iPhone and China. They cut their revenue estimate 4% to $90.8 billion, and cut their earnings estimate 7% to $1.51 per share. But the consensus already is at $90.78 billion and $1.51 – they are just getting in line with the rest of the Street. They kept their “Buy” rating and $220 target price.

Apple’s May 2 earnings announcement probably will be mildly disappointing, although Services revenue will set another new record. But the tip-off will be if the stock goes up over the following few days – that would set off a scramble to get back in. My first target is $225 to $250 by this time next year.

Recommended Action: Buy AAPL.