Starbucks Corp. (SBUX) began with a single store location in Seattle’s Pike Place Market in 1973, but has grown over time to more than 38,000 stores worldwide. Approximately half of the stores are located in the US and nearly 20% are in China. The company has a market capitalization of $100 billion and generates annual revenue of $37 billion, highlights Ben Reynolds, editor of Sure Dividend.

Starbucks reported financial results for the first quarter of fiscal year 2024 (Starbucks’ fiscal year ends the Sunday closest to September 30) on Jan. 30. The company maintained its strong business momentum and grew its comparable store sales more than 5% thanks to 5% growth in North America and 7% growth in international markets. Same-store sales in China grew 10%.

Adjusted earnings per share grew 20%, from $0.75 in the prior year’s quarter to $0.90, but missed the analysts’ consensus by $0.04. Yet the headwinds from the lockdowns in China and high inflation have subsided.

Starbucks lowered its guidance for growth of sales in fiscal 2024 from 10%-12% to 7%-10%. But it reaffirmed its guidance for 15%-20% growth of earnings per share, in line with its long-term guidance of 15%-20% growth of the bottom line. Accordingly, we expect earnings per share of $4.15 this year.

Starbucks’ chief competitive advantage is the sheer size and scale of its network. The company has an incredible number of stores in its portfolio and continues to aggressively expand its footprint, as seen in the most recent quarterly report.

Starbucks also has an enormous customer pool that remains very loyal to the brand even as price increases have been implemented in recent years. The company’s active reward users totaled 34.3 million as of the end of the quarter, a 13% increase from the prior year.

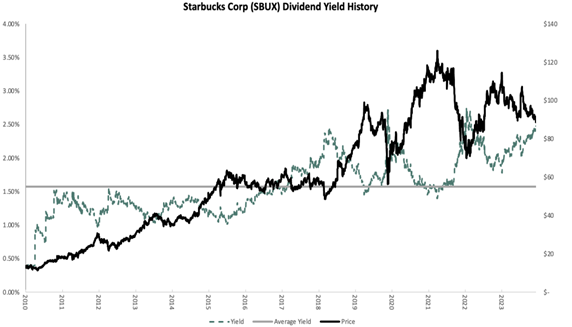

The dividend has increased for 13 consecutive years and the stock recently offered a current yield of 2.6% with an expected payout ratio of 55% for fiscal year 2024.

Recommended Action: Buy SBUX.