Barrick Gold Corp. (GOLD) just agreed to sell its 50% stake in the Donlin project in Alaska for $1 billion. On the one hand, the project has not been advancing for years and is only 1% of Barrick’s NAV. But the project has large potential and today’s higher gold price justifies moving it forward, writes Adrian Day, editor of Global Analyst.

Being in the US, it would have offset some of Barrick’s high jurisdictional risk, though there are environmental and social risks. Selling a high-potential gold mine in a safe jurisdiction perhaps reinforces Barrick’s switch in emphasis towards copper. The price tag, however, was a very good one for Barrick.

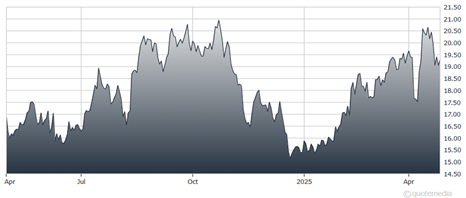

Barrick Gold Corp. (GOLD)

It is also reported that Barrick is looking for buyers for Hemlo, its last gold mine in Canada. Again, for a company that has long stated its desire to build gold operations in Canada, but consistently failed to bid on large development assets that were available, this is a sign that perhaps that goal no longer exists. It is also arguably another step on the road to redomiciling the company to the US.

Barrick is also selling a couple of smaller gold mines in Africa. Increased evidence that there will not be a quick solution to the long dispute with Mali over its shuttered Loulo-Gounkoto mine comes with reports that subcontractors are laying off several hundred employees.

Barrick has stopped paying the subcontractors and is moving thousands of workers to mines in other countries. Though Barrick stock could fall more in the near term if the gold price consolidates, if you are underweight the seniors, this would be one to buy at this time.

Recommended Action: Buy GOLD.