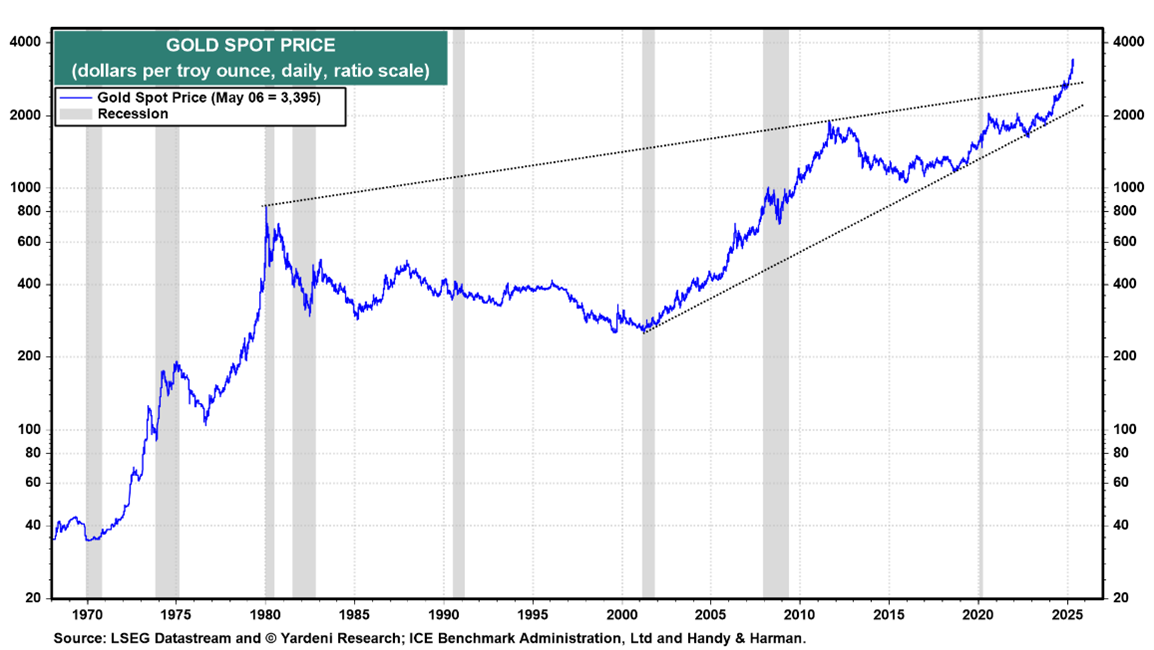

This year’s most spectacular and reliable bull market has been in geopolitical crises. Gold’s record-breaking rally looks less speculative by the moment as tensions flare up in every corner of the globe, writes Ed Yardeni, editor of Yardeni QuickTakes.

Even in this most tumultuous of environments, virtually no one had nuclear-armed India and Pakistan coming to literal blows on their Bingo card. This isn’t just true of the folks in the trading pits in New York and London, but also in Mumbai and Karachi. Suddenly, dustups between China and US seem less scary, especially with Xi Jinping’s negotiators set to sit down with Donald Trump’s later this week.

(Editor’s Note: Ed will be speaking at the 2025 MoneyShow Masters Symposium Miami, scheduled for May 15-17. Click HERE to register.)

Meanwhile, inside China, President Xi is struggling with a rare side effect of tariffs: Angry protests. News of irate factory workers demanding back pay dramatizes Goldman Sachs’ estimate that as many as 20 million mainland jobs are directly dependent on US-bound shipments.

As it turns out, Xi may have an easier time hiding trade war pain abroad than at home. Wednesday’s rate cut by the People’s Bank of China suggests that the sense of alarm is growing. The Chinese government's 10-year bond yield continues to signal deflation.

Bottom line: If tensions in myriad hotspots heat up, the only thing that might be in shorter supply than safe havens is sleep.