Gold continues to deliver higher returns than stocks. Mining companies have built-in leverage. So, their stocks typically move in the same direction as gold, but by greater percentages. I like the iShares MSCI Global Gold Miners ETF (RING), says Bob Carlson, editor of Retirement Watch.

Long-time readers know that I believe gold’s significant run to record highs primarily is the result of some central banks gradually moving a portion of their reserves out of dollar-based assets into gold. These central banks, primarily in Asia, are responding to the sanctions imposed on Russia after it invaded Ukraine.

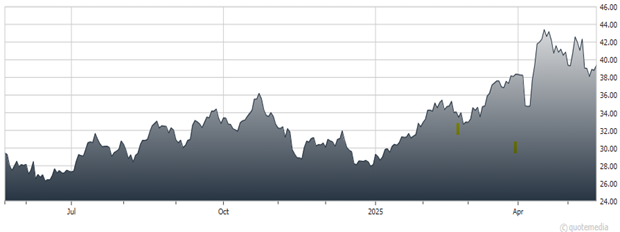

iShares MSCI Global Gold Miners ETF (RING)

Gold also is supported by the difficulty Congress faces in reducing the growth of US government deficits and debt.

RING owns about 50 securities, with 73% of the fund allocated to the 10 largest positions. About 54% of the fund is invested in companies based in Canada, while 20% of the fund is in US companies and 13% in South African miners.

Top holdings recently were Newmont Corp. (NEM), Agnico Eagle Mines Ltd. (AEM), Barrick Mining Corp. (B), Anglogold Ashanti Plc (AU), and Kinross Gold Corp. (KGC). The ETF was recently up 12.2% in four weeks, 23.8% over three months, 50.5% year-to-date, and 51.6% over 12 months.

Recommended Action: Buy RING.