Moody’s just became the last major credit-ratings agency to downgrade US debt from Aaa to Aa1. That triggered a small rally in gold and silver prices. At the same time, Dolly Varden Silver Corp. (DVS) announced a strategic purchase in the Golden Triangle, notes Peter Krauth, editor of Silver Stock Investor.

Standard & Poor’s was the first to downgrade America’s debt back in 2011, followed by Fitch in 2023. As a result of this latest downgrade, the government is taking steps to try and address the issue and help ease pressure in the bond market. But investors have been demanding higher yields, which have been ramping up since last fall.

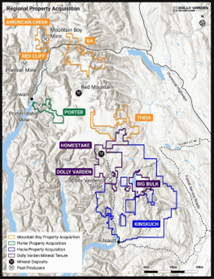

As for DVS, we’re seeing yet more growth by acquisition. The team is buying a suite of properties covering more than 20,000 hectares in the Golden Triangle of British Columbia, where their Flagship Kitsault Valley Project is located.

As for DVS, we’re seeing yet more growth by acquisition. The team is buying a suite of properties covering more than 20,000 hectares in the Golden Triangle of British Columbia, where their Flagship Kitsault Valley Project is located.

This new purchase from MTB Metals Corp. (MBYMF) includes four properties: American Creek Property (consisting of Mountain Boy Property, Silver Crown Property, and Dorothy Property), the Theia Property, the BA Property, and the Red Cliff Property.

Three of these properties have road access, are proximal to power, and are proximal to the recently completed Premier gold-silver mill near the port of Stewart, BC. Dolly is paying MTB Metals with 500,000 common shares at $3.59 and a NSR royalty of 1% on all production from Mountain Boy, BA, Theia, and Silver Crown.

This map shows in orange the properties included in this acquisition, as well as the recent Kinskuch addition. The combined land package offers strong silver, gold, and base metal potential across multiple underexplored targets hosted in favorable stratigraphy, with proximity to infrastructure and historic high-grade production.

Recommended Action: Buy DVS.