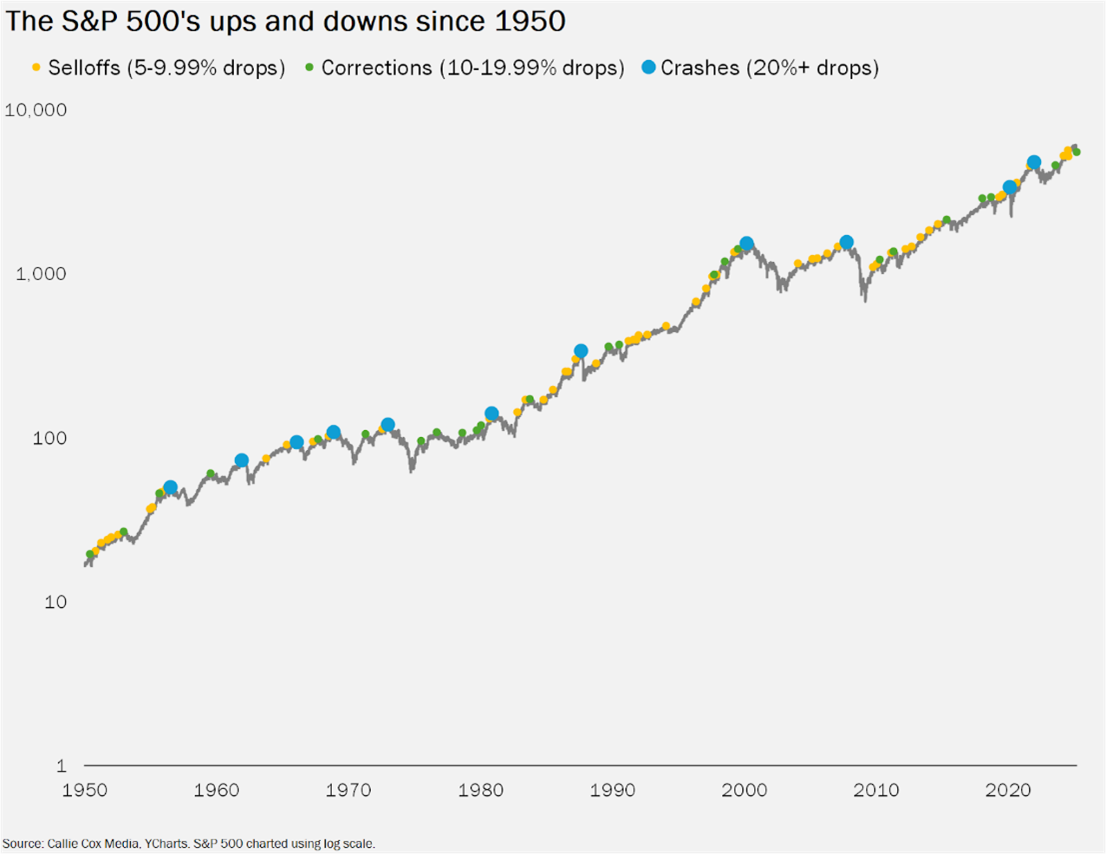

I’ve studied the stock market pretty intensely for almost 12 years now. Over a decade of pulling lines of data, building spreadsheets, adding spreadsheets on top of those spreadsheets, and marveling at the parallels that exist between economic cycles and human reactions. This week, I want to share one of the five craziest facts I’ve pulled about the S&P 500 Index (SPX), notes Callie Cox, chief market strategist at Ritholtz Wealth Management.

Here it is: One-third of S&P 500 selloffs have lasted less than a month!

Yes, the mood can change quickly when markets start to slide. Podcasters’ voices sound a little more frantic. Business news channels run special programming on markets in turmoil. Your grandma starts asking you what’s wrong with the Dow.

Fast-forward a month, and that world-altering event you were chewing your fingernails over is a distant memory. This happens a lot. More often than you think.

Since 1950, there have been 92 drops in the S&P 500 of 5% or more (from 52-week high to low). One-third of those selloffs lasted less than a month, and 86% of these selloffs ended before entering a dreaded bear market (20% below the highs).

That’s right. Most of these moments are blips on the radar, yet your lizard brain keeps panicking.

What this means for you: Pay attention to your portfolio’s numbers, not the bright flashes in your brokerage account. Invest confidently until we hit a recession, which is often the cause of bear markets/big crashes. And even then, invest confidently once your financial house is in order.