US stocks tend to attract the most attention in the market — but that doesn’t mean that there aren’t strong prospects elsewhere in the world. Among the stellar stocks our Zen Ratings system tracks is Qifu Technology Inc. (QFIN), observes Steve Reitmeister, editor of Zen Investor.

Diversifying geographically can be a method of hedging against volatility — something that's rampant in the market right now in the face of tariff flip-flopping and inflation. Qifu operates in a very specific and very interesting niche: Artificial Intelligence (AI) credit services.

The company currently acts as an intermediary, matching clients with financial institutions. While that does limit revenue, this facilitation-driven model is also asset-light.

Qifu Technology Inc. (QFIN)

At present, Qifu Technology is partnered with more than 160 financial institutions — and serves more than 250 million clients in China. While the company initially focused on underserved individuals and small businesses, it has since expanded — and we’ve seen plenty of examples of how strong domestic operations lead to international success for Chinese ventures.

QFIN stock has a Zen Rating of A. At present, it ranks in the top 5% of the equities we track — and stocks with this distinction have historically provided an average annual return of 32.5%.

Meanwhile, value is QFIN’s strongest suit. The stock is currently trading at a price-to-earnings (P/E) ratio of just 6.48x, and a price/earnings to growth (PEG) ratio of 0.78x. In this regard, the stock ranks in the top 5% of the equities we track.

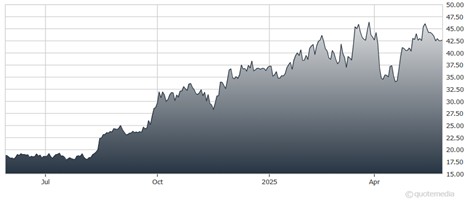

On account of its current uptrend, the stock also ranks in the top 7% in terms of Momentum — and despite strong expansion, it maintains a healthy checkbook, clocking in in the top 10% in terms of Financials.

Recommended Action: Buy QFIN.