Markets entered the new week with a steady tone as investors shifted their attention from earnings season toward key economic updates. While most first quarter results are behind us, a few notable companies are still set to report and could offer valuable insight into the health of the consumer, notes Gav Blaxberg, CEO of Wolf Financial.

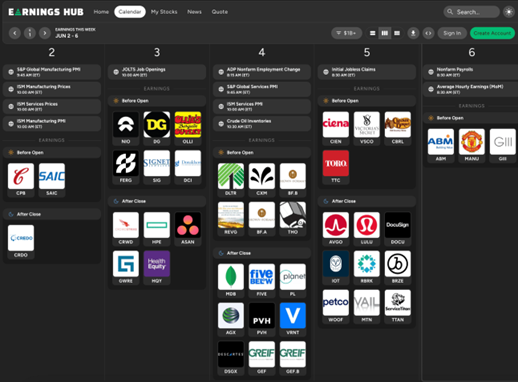

Among the most anticipated earnings this week are reports from CrowdStrike Holdings Inc. (CRWD), Five Below Inc. (FIVE), and Lululemon Athletica Inc. (LULU). These companies span different corners of the retail and technology landscape.

Five Below will help paint a picture of how lower-income consumers are spending, while Lululemon will offer a view into higher-end retail demand. CrowdStrike’s results will give us a read on corporate tech spending and security budgets.

Expectations heading into earnings season were muted, yet many companies managed to exceed forecasts. That has helped support equity markets over the past few weeks. Underpinning that resilience has been continued strength in the labor market. Despite tighter financial conditions, employment trends remain strong, and layoffs have stayed relatively low.

This week brings more clarity on that front. The labor market will be in focus with Thursday’s jobless claims report and Friday’s nonfarm payrolls release. Together, they will give us a timely look at both short-term and longer-term employment conditions.

From a market perspective, the current environment feels stable but cautious. With earnings season winding down and no immediate signs of a change in policy from the Federal Reserve, investors may wait for a clearer direction before making bold moves. While upside in the near term might be limited, the backdrop for the second half of the year looks positive.

My advice? Focus on the positive and keep an optimistic outlook.