The market has leveled off since the huge recovery from the tariff Armageddon fears. Now, who knows? Meanwhile, Oracle Corp. (ORCL) is a technology stalwart with strong growth catalysts ahead thanks to data centers and AI, writes Tom Hutchinson, editor of Cabot Income Advisor.

The sticky issue is increasing trade tensions with China and the US. A war of words is escalating between the two governments and threats are being made by both sides. It is being reported that President Trump will speak with Chinese President Xi. Hopefully the two leaders will bring down the temperature.

Investors seem to have decided that these tariff issues won’t cause a disaster. Sure, there may be more headlines that the market doesn’t like. But tariffs shouldn’t wreck the bull market. The “no disaster” trade has played out though, and the market will likely need more good news to move meaningfully higher from here.

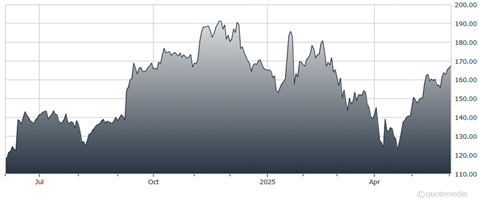

Oracle Corp. (ORCL)

As for ORCL, OCI revenue grew 49% last quarter. The company also reported that it had $130 billion in order backlogs, a 63% increase from last year’s quarter. There isn’t nearly enough current data center capacity to meet demand.

Oracle opened its 101st Data Center Cloud Region last quarter. Management intends to double data center capacity this fiscal year and triple it by the end of next fiscal year. The company plans to eventually operate between 1,000 and 2,000 of these data centers.

Recommended Action: Buy ORCL.