Mid-America Apartment Communities Inc. (MAA) specializes in acquiring, developing, and managing apartment communities. It owns and operates nearly 300 properties in 16 states and Washington, DC. The company’s focus on innovation and technology presents opportunities for growth, enabling it to cater to evolving tenant preferences and expectations, advises Kelley Wright, editor of IQ Trends.

MAA caters to a varied demographic, providing housing solutions that range from luxury apartments to more affordable options. The Real Estate Investment Trust’s operations are predominantly concentrated in the Sun Belt region, an area with robust population growth, economic expansion, and favorable climate conditions. MAA boasts a geographically diverse portfolio that spans multiple states, encompassing urban, suburban, and metropolitan areas.

With thousands of units under management, the company has strategically positioned itself to capitalize on market demand while maintaining a strong emphasis on quality and customer satisfaction. MAA’s success can be attributed to its well-defined strategic framework, which emphasizes both organic growth and expansion through acquisitions.

By focusing on regions with high population density and economic activity, the company ensures a steady stream of demand for its properties. Additionally, MAA employs robust market analysis to identify emerging opportunities, allowing it to adapt swiftly to shifting trends in the real estate sector.

MAA’s primary challenges include fluctuating market conditions, regulatory changes, and the impact of economic cycles on the real estate sector. However, its strategic agility and diversified portfolio provide a strong foundation to navigate these uncertainties.

The ROIC, FCFY, and P/EBV are 6%, 2%, and 3.9 respectively. Economic earnings are -$1.05 vs. $8.77 reported. Economic Book Value equals $38.29 per share. Finally, $10,000 invested five years ago is now approximately $15,326.

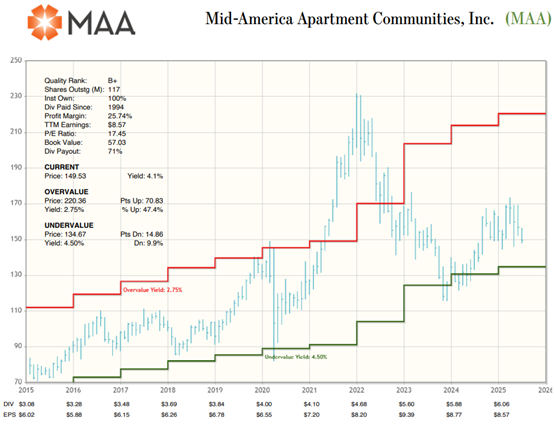

Recommended Action: Buy MAA.