Humanoid robots are no longer just science fiction. Their arrival on Wall Street — via two new ETFs, KraneShares Global Humanoid and Embodied Intelligence Index ETF (KOID) and Roundhill Humanoid Robotics ETF (HUMN) — signals that serious money is starting to chase a once-fantastical theme, suggests Nicholas Vardy, editor of The Global Guru.

This ETF showdown is a tale of two tech frontiersmen: one measured and methodical, the other a gunslinger. For investors hungry for 10x upside, these two ETFs offer very different ways to play robotics-revolution breakthroughs.

Elon Musk says Tesla Inc.’s (TSLA) Optimus bot could be bigger than its car business. Goldman Sachs Group Inc. (GS) pegs the humanoid market at $150 billion by 2035. Ark Invest sees a trillion-dollar annual GDP boost from robotic labor in the coming decades. That might still be conservative.

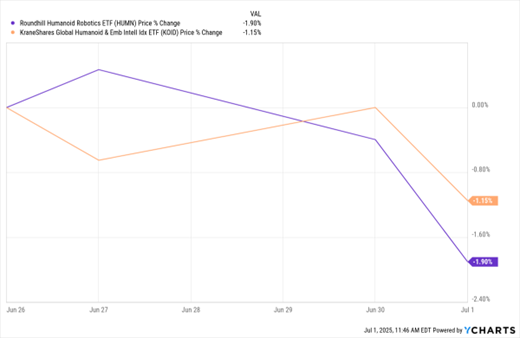

HUMN, KOID (1-Week % Change)

Data by YCharts

The global economy faces structural labor shortages. Humanoids promise to be the “steel-collar workers” that step into the breach. US manufacturing will be short 2 million workers by 2030. Aging societies like Japan and South Korea are desperate for scalable care solutions. Global industrial automation already attracts over $250 billion in annual investment.

Humanoids aren’t just sci-fi anymore. They’re the next productivity boom — with arms and legs.

KOID is a passive, rules-based ETF that tracks 51 equally weighted global names. It mixes big players like Nvidia Corp. (NVDA) and TSLA with niche enablers like MP Materials Corp. (MP), and has a geographic spread across the US, China, and Japan.

HUMN is actively managed, with 30 high-conviction positions. It targets core builders of humanoids and enabling tech (sensors, AI, materials) – and has concentrated exposure to TSLA, NVDA, plus Asia/Europe niche leaders.

In tech investing, the 80/20 rule becomes the 95/5 rule: a few names drive nearly all the gains. HUMN leans into that math. KOID spreads the risk — and the reward. Want smoother volatility? KOID. Want a shot at the next Nvidia? HUMN.