Once again, investors have been reminded that far more money has been lost in trying to anticipate corrections than has been lost in the corrections themselves. Meanwhile, TotalEnergies SE (TTE) is a French-based, integrated energy company with operations spanning oil, gas, LNG, refining, and renewables that I like here, writes John Buckingham, editor of The Prudent Speculator.

Alas, they don’t ring a bell to sound an all-clear signal and stocks often climb a Wall of Worry. Indeed, despite corrections and even Bear Markets along the way, equities have managed to trend higher throughout our sometimes-turbulent history.

Stock prices and corporate profits, which are measured in actual (not inflation-adjusted) dollars, benefit over time from both real and nominal economic growth. It is amazing that so many think they can outguess market gyrations, egged on by a financial press that finds the proverbial glass half-empty or half-full based on short-term moves.

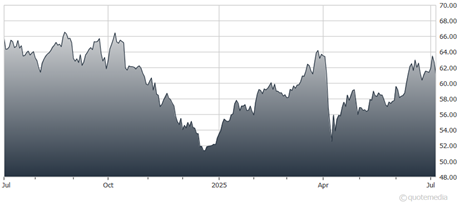

TotalEnergies SE (TTE)

As for TTE, management has said it aims to grow cash flow per share by 4% annually through 2030 via accelerating returns from integrated power and renewables. It will also maximize cash flow from low-cost oil and LNG production and maintain strict capital discipline.

Recently, TTE announced the restart of its $20 billion Mozambique LNG project. It also acquired a 25% stake in Suriname’s Block 53 near its GranMorgu development. Plus, it has advanced several carbon capture and solar initiatives.

We appreciate the diversity of TTE’s operations and low-cost oil projects that underline consistent returns of capital. Indeed, the company plans to maintain its share repurchase rate of $2 billion per quarter and it increased the dividend by 7.5% earlier this year. A 10% slide for shares over the past 12 months puts the NTM P/E ratio at nine, while the net dividend yield is 5%.