Utilities have somehow beaten the odds even with rate hikes and rotation — but they’re quietly entering a golden age…with solid tailwinds. Buy the Utilities Select Sector SPDR ETF (XLU), suggests Luke Lloyd, founder and CEO of Lloyd Financial Group.

Here is why I like XLU:

1. Disinflation + Rate Cuts = Rotation Back to Yield: As interest rates fall, dividend-paying utilities become attractive again.

2. AI’s Hidden Energy Crisis: Every ChatGPT prompt and AI server farm requires massive energy infrastructure. That buildout won’t be in Silicon Valley — it’ll be in the grid.

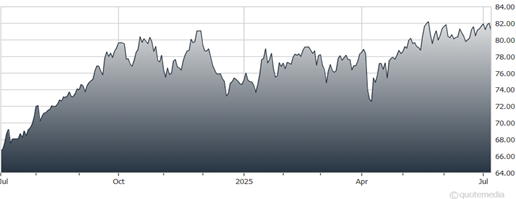

Utilities Select Sector SPDR Fund (XLU)

Utilities will benefit from both higher demand and infrastructure spending. This is where fundamentals meet macro tailwinds. It’s a double-play on falling rates and surging AI energy consumption.

The crowd is still crowding into “AI growth” plays without thinking second-order. But you don’t just want the tools of AI — you want the macro consequences of it.

That means front-running a deflationary environment with long-duration assets and infrastructure picks.