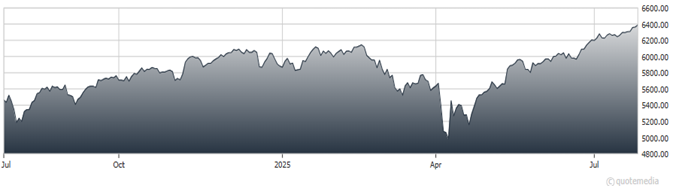

US equity markets have been on a tear from the April lows, with the S&P 500 Index (^SPX) surging more than 30% from its 2025 intraday low. Given this week’s full plate of economic readings and earnings reports, some investors were nervous that it may derail the rally. If that’s going to be the case, it won’t be because of the JOLTS or consumer confidence reports, highlights Bret Kenwell, US investment analyst at eToro.

While the JOLTS report slightly missed expectations and dipped after back-to-back months of increases, the report was mostly in-line with expectations. Furthermore, revisions to the prior report were minor, pointing to a relatively stable situation in the labor market.

S&P 500 Index (^SPX)

As for consumer confidence, readings were slightly above expectations, while last month’s reading was revised higher. Confidence continues to inch up with US equities back to all-time highs, the economy and labor market showing resilience, and worries around tariffs continuing to fade. If those trends continue — and if trade deals progress — then consumer confidence may continue to rebound in the second half of 2025.

For investors, the fact that consumers and businesses continue to show their optimism and resilience in the face of multiple headwinds has pushed US stocks back to record highs. As good as that feels right now, we have yet to take on this week’s main hurdles.

That includes today’s Fed meeting, Friday’s jobs report, and a bevy of earnings — including four of the Magnificent 7 stocks. If those events tell a similar story of economic and labor market stability, equity markets have the catalysts in place to continue higher, with pullbacks likely being viewed as buying opportunities.