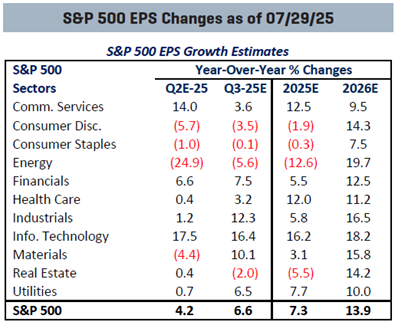

The Q2 2025 earnings reporting period is well underway. Second quarter earnings per share are projected to rise 4.2% on a year-over-year basis, according to S&P Capital IQ consensus estimates, versus the 2.2% growth forecast as of June 30, highlights Sam Stovall, chief investment strategist at CFRA Research.

Seven sectors are seen posting advances, led by communication services, financials, and technology, while consumer discretionary, energy, and materials should endure the deepest declines. For all of 2025, companies in the S&P 500 Index (^SPX) should post a 7.3% YOY EPS rise, versus the 6.8% initial estimate, followed by an increase in 2026 to 13.9%.

(Editor’s Note: Sam will be speaking at the Value Proposition in Value Investing Virtual Expo, scheduled for Aug. 5-6, 2025. Click HERE to register for a FREE pass.)

Full-year 2025/2026 gains for the S&P MidCap 400 and S&P SmallCap 600 are now seen at +3.7%/+18.6% and +7.2%/+20.4%, respectively. Finally, the S&P 500’s P/E on forward 12-month EPS stands at 23.4x, a 22.3% premium to its 10-year average.

Meanwhile (and as widely expected), the Federal Reserve left the federal funds rate range unchanged at 4.25%-4.50%. In our view, reasons for the lack of movement included a stronger-than-expected advance Q2 GDP report, a resilient US jobs market, and ongoing tariff uncertainties.

We still think there is a good chance that the Fed will announce a 25-basis point cut at the September meeting. In addition, the September meeting will mark the one-year anniversary of the first rate cut of the current easing cycle. Since Sept. 18, 2024, the FOMC has reduced the funds rate by a full percentage point in three separate actions.

The S&P 500 has risen 13.2%, well above that average 3.7% seen in the prior six easing cycles since 1990. Typically, the period between the last rate hike and first rate cut has seen superior stock price gains (nearly 18% on average since 1990) – and greater consistency of gains (up six of seven times) – than the 12 months after the first cut.