I laid out two very distinct scenarios in last Sunday’s short: A dip into earnings if traders wanted lower prices OR a run higher followed by a “rug pull” after otherwise great numbers. Now we know what’s what. So do you buy the dip…or do something else? Here’s my take, writes Keith Fitz-Gerald, editor of 5 With Fitz.

The news is already calling it another “tariff tantrum.” Predictable. It’s an opportunity. Doesn’t matter if you’re a trader or an investor. Markets don’t move in straight lines and never have.

(Editor’s Note: Keith is speaking at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18. Click HERE to register.)

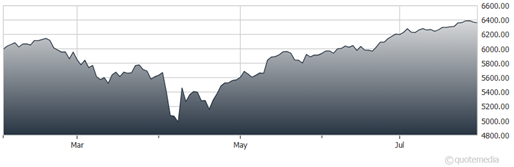

S&P 500 Index (^SPX)

You can almost set your watch to what happens:

• Strong run-up

• Brief pullback for whatever reason du jour

• Traders overreact

• Smart, successful investors stay the course

The noise on Friday was just that — noise. Moreover, it proves a point I make incessantly. You’ve got to be in to win — if winning is what you actually want to do. And if you’re not willing to invest when the chips are down, you can’t expect to be ahead when they’re up.

Millions of investors were caught like deer in the headlights after a rock-solid week of great earnings. They were left wondering: Is this the start of a larger pullback into fall or a short-term, headline-driven drop? And should I buy or sell?

Depends on your personal risk tolerance, objectives, and circumstances (which I don’t know). Personally, I’m staying in the game and going shopping if the red deepens. The markets are the only store on earth where people fear a sale.