Texas Roadhouse Inc. (TXRH) reported a meaty 12.7% increase in second quarter revenue to $1.5 billion, with net income increasing 3% to $124 million and EPS up 4% to $1.86. Comparable restaurant sales increased 5.8% at company restaurants, writes Ingrid Hendershot, editor of Hendershot Investments.

Average weekly sales at company restaurants were $167,350, up 5.2% from last year, of which $22,243 were to-go sales, up 11% from last year. Restaurant margin dollars increased 6.1% to $257.3 million, primarily due to higher sales.

Restaurant margin, as a percentage of restaurant and other sales, decreased 108 basis points to 17.1% as commodity inflation of 5.2% and wage and other labor inflation of 3.8% were partially offset by higher sales.

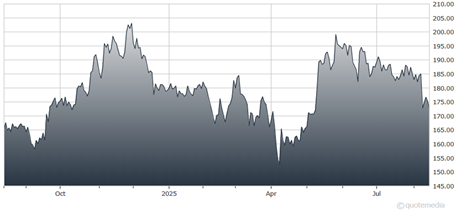

Texas Roadhouse Inc. (TXRH)

During the quarter, four company restaurants and one franchise restaurant were opened, bringing the total to 797 restaurants on June 30. During the first half of 2025, Texas Roadhouse generated $196 million in free cash flow, down 12% from last year. The company returned $150.7 million to shareholders year-to-date via dividend payments of $90.3 million and share repurchases of $60.4 million.

Texas Roadhouse ended the quarter with $176.8 million in cash, no long-term debt, and $1.4 billion in shareholders’ equity on its beefy balance sheet. Looking ahead to the full year, management reiterated positive comparable restaurant sales growth. It cites the benefit of menu pricing actions, store week growth of approximately 5%, and total capital expenditures of approximately $400 million.

Recommended Action: Buy TXRH.