A Cannibal is a business that “eats” or buys back its shares. They can be very attractive investments. The reasoning? In the long run, stocks always follow Earnings Per Share (EPS). Let’s take a look at O’Reilly Automotive Inc. (ORLY) as an example, says Pieter Slegers, editor of Compounding Quality.

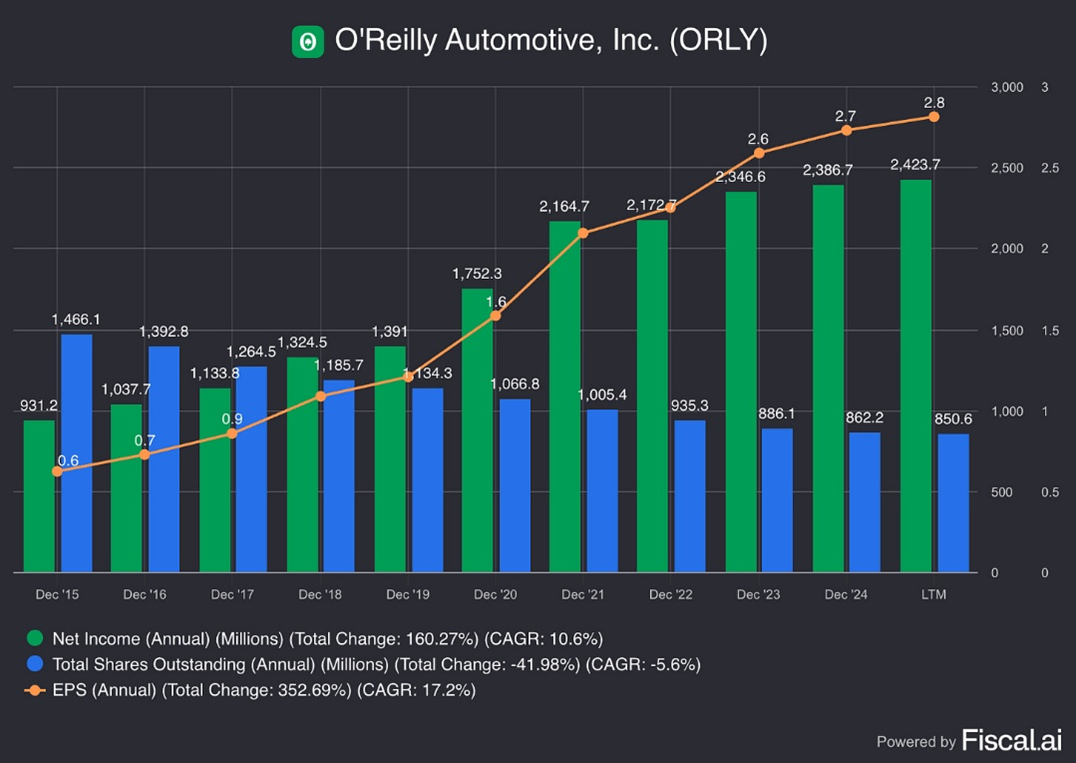

Since EPS = Earnings / Total Shares Outstanding, the only ways to improve EPS are to grow earnings or reduce the total shares outstanding. A great cannibal does both. Look at ORLY.

This is the kind of chart I dream about at night. O’Reilly is buying back its shares while increasing net income at the same time. The result? An average return of 20.2% over the past 10 years. This means $10,000 invested in O’Reilly would now be worth $62,900.

But what if the total shares outstanding would increase? That’s exactly what Stock-Based Compensation (SBC) does. As the name suggests, SBC is compensation based on stocks. It allows companies to pay employees with stock instead of cash.

The problem with this is dilution. When more shares are issued, your ownership stake shrinks. To avoid too much dilution, we always use these two rules:

• Stock-Based Compensation as a percentage of net income should be lower than 10%

• Avg. SBC as a percentage of net income past five years should be lower than 10%, too