US companies have announced $983.6 billion worth of stock buybacks so far this year, the best start to a year on record, according to Birinyi Associates. The 20 largest companies account for almost half of repurchases. One fund I like here is the Tweedy, Browne Insider and Value ETF (COPY), notes Carl Delfeld, editor of Cabot Explorer.

Meanwhile, all the talk about foreign countries and companies needing to invest more in America ignores that since 2006, foreign investments in US assets have outpaced our investments in foreign assets by about $26 trillion. As recently as 2023, the US received nearly $2 trillion in foreign capital inflows. Foreign countries also own about 25% of our outstanding government bonds and 20% of the US stock market.

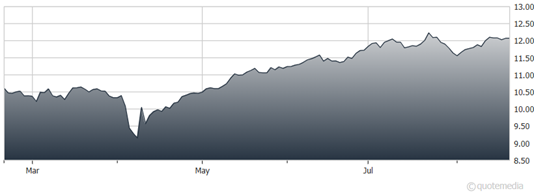

Tweedy, Browne Insider and Value ETF (COPY)

Now let’s turn to another innovative ETF to lower risk and add some value stocks to our core portfolio. One of the first stock funds I purchased was a Tweedy, Browne fund, and how I wish I had held on to it. Tweedy, Browne was founded in 1920 and now has only $8.6 billion in assets.

COPY offers a potent combination of value, international, and small-cap stocks. This ETF targets the following five characteristics:

1) Low price-to-book and price-to-earnings multiples

2) Share repurchases

3) Small-cap orientation

4) Above-average dividend yields

5) Out-of-favor, mispriced stocks.

This is a great company – and ETF in an uptrend.