When I learned about the business operations of refining companies a decade ago, I became a fan of the sector and the long-term profit rewards that investors can earn from it. My favorite name is Marathon Petroleum Corp. (MPC), notes Tim Plaehn, editor of The Dividend Hunter.

Crude oil refiners are fascinating because they operate extremely complex refineries and must be very efficient. For a refiner, both the input (crude oil) and the output (gasoline and other fuels) have prices set by market forces. Profit margins per barrel of processed oil can swing dramatically.

In the US, we have three refining companies of similar size:

- MPC with a $51 billion market cap

- Phillips 66 (PSX), $48 billion market cap

- Valero Energy Corp (VLO), $41 billion market cap

Of the three, Marathon Petroleum has provided the best returns to investors and has been a long- recommended stock in my Monthly Dividend Multiplier newsletter service.

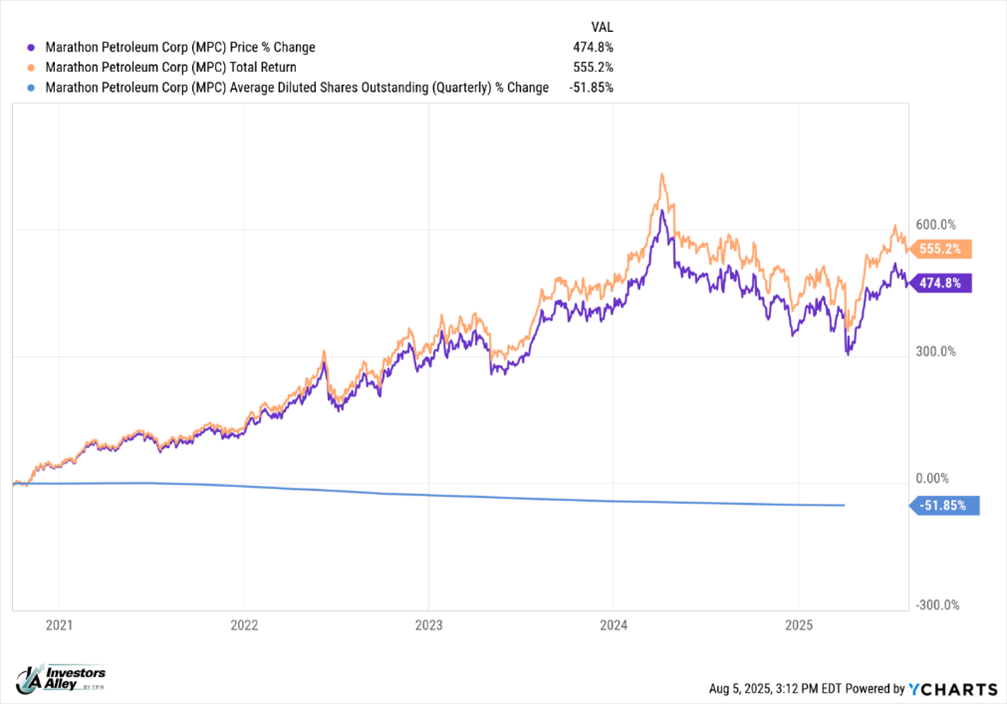

Marathon’s returns have been driven by steady 10% annual dividend growth and the company’s buyback of outstanding shares, which automatically boosts net income per share. The dividend has increased by 57% over the last five years, while the number of shares outstanding has decreased by 52% during the same period.

The chart above shows the five-year share price and total returns for MPC. Yes, investors earned 555% over the last five years. That provides proof that dividend growth stocks, such as MPC, can provide excellent long-term returns in your portfolio.