NetApp Inc. (NTAP) reported a good fiscal Q1, but shares plunged in after-hours trading on Wednesday, before recouping all those losses and then some by soaring on Thursday, only to sink anew on Friday. For the full week, shares advanced more than 2%, even as the storage and data management concern offered only a modestly positive outlook, highlights John Buckingham, editor of The Prudent Speculator.

NetApp reported $401 million in operating profit and an adjusted earnings per share figure of $1.55. Net revenue was $1.56 billion, compared to the consensus estimate of $1.55 billion. Hybrid cloud revenue grew 1% year-over-year to $1.4 billion and Product revenue shrank 2% year-over-year.

CEO George Kurian said: “Robust performance in the Americas enterprise offset year-over-year declines in US Public Sector and EMEA. This success was fueled by strong demand for our all-flash offerings, first-party and marketplace cloud storage services, and AI solutions.”

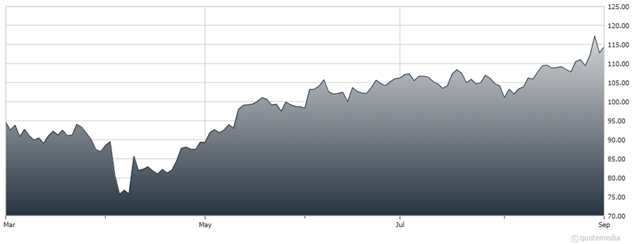

NetApp Inc. (NTAP)

Mr. Kurian closed: “Our highly differentiated cloud services enable hybrid and multi-cloud transformations, and we are well-positioned and growing in the emerging area of enterprise AI. I’m excited about the advantages we bring to customers in these critical areas.”

NTAP expects Q2 EPS to come in between $1.84 and $1.94. Analysts were expecting $1.87. Net revenue is expected to be $1.62 billion to $1.77 billion, which at the midpoint is above the $1.68 billion estimate.

At the end of Q4, NetApp had $3.3 billion of cash on its balance sheet and $2.5 billion of debt, resulting in a net cash position of $840 million. The company spent $300 million on share repurchases and $104 million on dividends.

All in all, NTAP’s outlook remained conservative, which was a disappointment last quarter also. Tariffs have been a concern, but management said they’re in a “wait-and-see mode” and the company has integrated some pricing changes into newer systems that keep up gross margins.

NTAP trades for an inexpensive 14x forward earnings and EPS is expected to grow in the 4% to 10% range over the next three years. Our Target Price is now $149.