It’s a critical week for investors as they size up the US labor market, which includes yesterday’s JOLTS report and Friday’s all-important monthly jobs report. The JOLTS report missed economists’ expectations, but investors may find relief in increased confidence for a rate cut later this month, observes Bret Kenwell, US investment analyst at eToro.

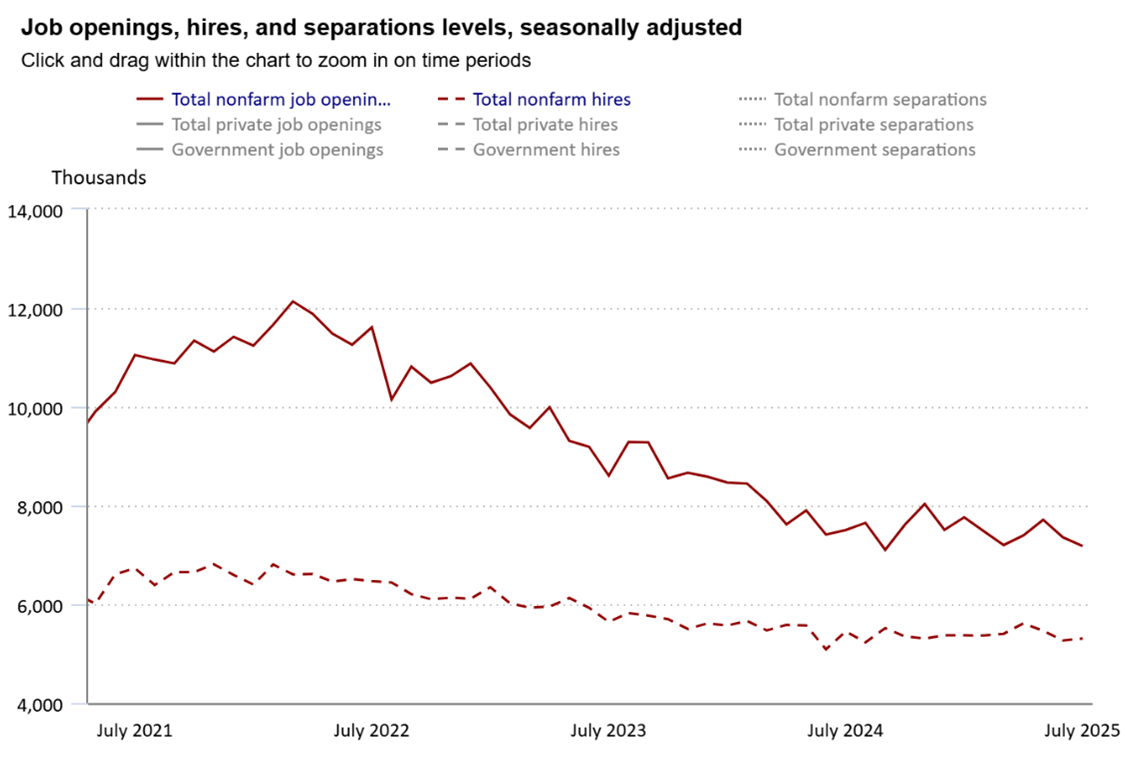

Job openings declined from the prior month and hit the lowest level since September 2024, while last month’s numbers were revised slightly lower. Layoffs also rose to their highest level since September 2024. They topped 1.8 million for just the fourth time since January 2021, and last month’s figures were also revised higher. The hiring rate of 3.3% remains at a one-year low.

Source: Bureau of Labor Statistics

The JOLTS report may not be flashing alarm bells, but it’s the latest data point that suggests the jobs market in the US is softening. Combined with the recent multi-year high in continuing jobless claims and the sharp downward revisions to job gains in recent months — both of which will be updated later this week — it underscores the weakening trend.

The US economy may have the cushion to absorb a softer jobs market. But investors don’t want to see the labor market get too weak.

In the short term, yesterday’s report is the latest data point that helps tip the Fed’s scale toward a rate cut, which we’re now likely to see later this month. But in the long-term, investors should not cheer for notable labor market weakness for the sole benefit of lower rates.