Alibaba Group Holding Ltd. (BABA) reported what we would call the greatest earnings “miss” of all time last week. Indeed, to call this quarter a “miss” is extremely misleading, writes Tom Hayes, editor of HedgeFundTips.

Top-line revenues were $34.5 billion (+2% year-over-year), falling $910 million short, and adjusted earnings per share of $2.06 came in $0.10 less than expected. But the Cloud segment posted its fastest growth in over three years, accelerating 26% YoY to $4.66 billion, while adjusted EBITA also rose 26% to $412 million.

(Editor’s Note: Tom is speaking at our 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. Click HERE to register.)

Alibaba Group Holding Ltd. (BABA)

Management expects continued acceleration over the next few quarters, with all signs pointing to +30% top-line growth, as Alibaba extends its lead as China’s #1 cloud infrastructure provider, holding and expanding its roughly 40% market share.

Alibaba’s newly organized China E-commerce group, including Taobao, Tmall, Ele.me, and Fliggy, reported 10% YoY revenue growth to $19.5 billion. Adjusted EBITA fell 21% YoY to $5.36 billion as heavier investments in instant commerce weighed on near-term profitability, though excluding these investments profitability would have improved.

Customer management revenue increased 10%, supported by last year’s 0.6% software service fee and stronger advertising demand. Double-digit growth in 88VIP memberships, now exceeding 53 million, was another key driver.

Alibaba International delivered 19% YoY revenue growth, reaching $4.85 billion. Adjusted EBITA improved 98% YoY to a loss of just $8 million, with profitability expected in the upcoming quarter.

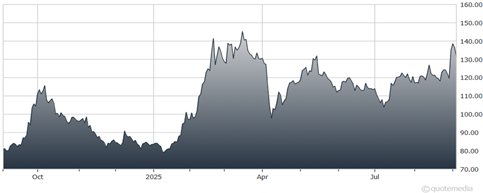

Management repurchased 7 million ADSs for $815 million at about $116 per share, with $19.3 billion in buyback dry powder remaining. Alibaba ended the quarter with $81.7 billion in cash and a net cash position just under $50 billion, roughly 15% of its market cap.