In a market flooded with passive sheep and overhyped mega-caps, the Royce Micro-Cap Fund (RYOTX) hunts where few dare — tiny companies with big upside and almost zero Wall Street coverage. Their playbook? Find stocks with deep value, strong balance sheets, and serious cash flow, notes Nicholas Vardy, editor of Microcap Moonshots.

Recent numbers? Five-year annualized return of 13.8%, crushing the Russell Microcap and outpacing the Russell 2000 across multiple timeframes. Yes, it’s volatile. But that’s the playground where real alpha hides.

This isn’t luck. It’s discipline. Lead manager Jim Stoeffel has steered the ship for over a decade, and he was joined by Andrew Palen in 2024. The fund thrives on inefficiency — buying what others miss, then waiting as value closes the gap.

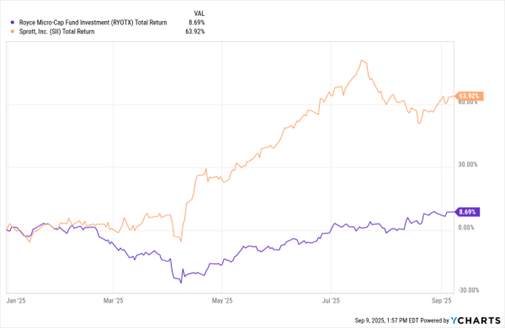

RYOTX, SII (YTD % Change)

Data by YCharts

With a 1.23% expense ratio, RYOTX isn’t cheap. But neither is edge. And in the micro-cap jungle, edge is everything.

Bottom line: If you want exposure to the last place on Wall Street where price discovery still works — and active management still matters — RYOTX is your hunting ground.

An example of one of its holdings (as of June): Sprott Inc. (SII) It isn’t just another asset manager. It’s a rare play on real assets when the world is waking up to commodity scarcity. This Canada-based firm gives investors surgical exposure to gold, uranium, and critical materials powering the clean energy revolution.

Whether it’s through ETFs, equities, or private deals, Sprott has one job: Own the stuff that actually matters when fiat cracks and infrastructure booms. With deep expertise, institutional backing, and a razor-sharp focus on metals, this is the anti-index, anti-fluff portfolio core for anyone who wants real diversification, not digital illusions.